Introduction

In an increasingly complex financial world, Enhanced Due Diligence (EDD) has become a fundamental component of anti-money laundering (AML) strategies for businesses, especially in jurisdictions like the United Arab Emirates (UAE). As regulatory scrutiny heightens, companies must not only conduct standard due diligence but also employ enhanced measures when dealing with high-risk clients or transactions. EDD aims to provide a deeper understanding of a client’s financial background, risk factors, and sources of wealth to ensure full compliance and minimize risks.

This guide will explore the key aspects of EDD in the UAE, including its importance, process, and best practices for effective implementation.

What is Enhanced Due Diligence (EDD)?

Enhanced Due Diligence (EDD) is a more intensive process of verifying customer information and assessing risks compared to standard due diligence. EDD is generally required for clients that pose higher risks, such as Politically Exposed Persons (PEPs), clients from high-risk jurisdictions, or those involved in unusually large or complex transactions. EDD involves gathering more detailed information, conducting deeper verification, and applying rigorous scrutiny to mitigate potential risks.

In the UAE, EDD is a regulatory requirement for certain categories of clients under the AML and Counter-Terrorist Financing (CTF) framework. It ensures that financial institutions and other businesses take proactive steps to prevent financial crimes by identifying red flags, understanding the client’s risk profile, and enhancing monitoring.

Importance of Enhanced Due Diligence in the UAE

1. Regulatory Compliance

The UAE is committed to aligning its AML/CTF framework with international standards, particularly those set by the Financial Action Task Force (FATF). EDD plays a crucial role in ensuring compliance with these regulations, especially for entities like banks, insurance companies, and designated non-financial businesses and professions (DNFBPs). Failing to comply with EDD requirements can lead to hefty fines, reputational damage, and potential legal action.

2. Identification of High-Risk Customers

EDD is particularly important for identifying and assessing the risks associated with high-risk customers. For example, PEPs or clients with complex corporate structures may pose a higher risk of money laundering or terrorist financing. Through EDD, businesses gain insights into the customer’s financial activities, sources of wealth, and business relationships, enabling them to take appropriate risk mitigation measures.

Learn more about identifying high-risk clients through our Risk Assessment Services.

3. Mitigating Financial Crime Risks

Enhanced due diligence helps businesses mitigate risks associated with financial crimes by providing a deeper understanding of their clients. By identifying unusual patterns or inconsistencies in a client’s financial activities, businesses can prevent money laundering, terrorist financing, and other financial crimes that could threaten the integrity of their operations.

4. Protecting Business Reputation

Failure to conduct proper EDD can have severe consequences for a business’s reputation. Associations with clients involved in money laundering or other financial crimes can result in reputational damage, loss of customer trust, and negative publicity. By conducting thorough EDD, businesses in the UAE can protect their reputation and demonstrate their commitment to compliance and ethical practices.

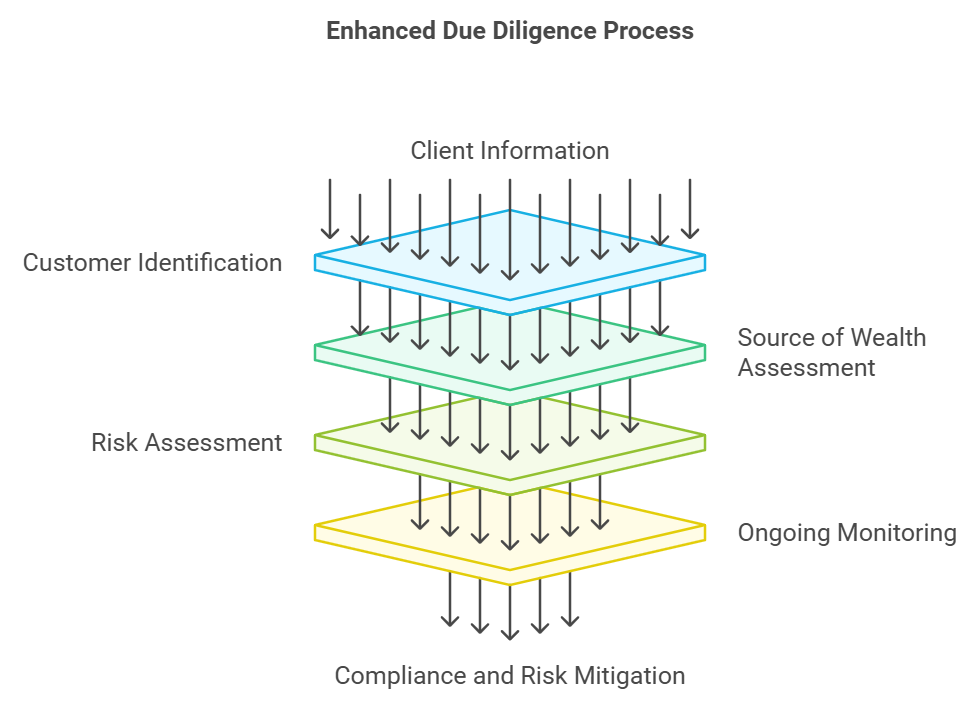

Key Steps in the Enhanced Due Diligence Process

1. Customer Identification and Verification

The first step in the EDD process is identifying and verifying the customer’s identity. Unlike standard due diligence, EDD requires additional verification documents, such as multiple forms of identification, proof of address, and detailed information about the client’s business activities.

For clients considered high-risk, such as PEPs, businesses must also collect information about their public roles, the purpose of their transactions, and any potential conflicts of interest. This helps in assessing whether the client’s activities align with their risk profile.

2. Assessing the Source of Wealth and Funds

One of the critical components of EDD is determining the source of wealth and source of funds. This involves gathering documentation that provides evidence of how the client obtained their wealth or the origin of the funds being used in a particular transaction. For example, this may include salary statements, investment portfolios, property deeds, or inheritance records.

Assessing the source of wealth helps businesses determine if the funds are legitimate or if there are any red flags that require further investigation. The process also ensures that the customer’s financial activities are consistent with their financial profile.

3. Ongoing Monitoring of Transactions

EDD is not a one-time process; it requires continuous monitoring of customer transactions to identify any suspicious activities or changes in behavior. Businesses must implement transaction monitoring systems that can detect unusual activities in real-time, such as large cash transactions, multiple smaller transactions, or cross-border transfers.

Ongoing monitoring also includes updating customer information regularly, especially when new information arises or when the client’s risk profile changes. This ensures that the business remains informed about its customers and can respond promptly to any potential risks.

4. Background Checks and Screening

Conducting comprehensive background checks is another essential step in the EDD process. This involves screening clients against international sanctions lists, PEP lists, and databases of adverse media reports. The goal is to identify any negative information that may indicate a higher risk of financial crime.

To learn more about how to conduct effective background checks, explore our Sanctions Screening Services.

5. Enhanced Risk Assessment

For high-risk clients, businesses must conduct an enhanced risk assessment to determine the appropriate level of scrutiny. This involves analyzing the customer’s risk factors, including geographic risk, industry risk, and transaction risk. By categorizing clients based on their risk level, businesses can allocate their resources efficiently and focus on clients that pose the highest risk.

6. Documenting the Due Diligence Process

All EDD activities must be thoroughly documented. Maintaining detailed records of the due diligence process, including customer information, verification documents, risk assessments, and ongoing monitoring activities, is crucial for regulatory compliance. Documentation provides evidence that the business has taken all necessary steps to mitigate risk and comply with AML regulations.

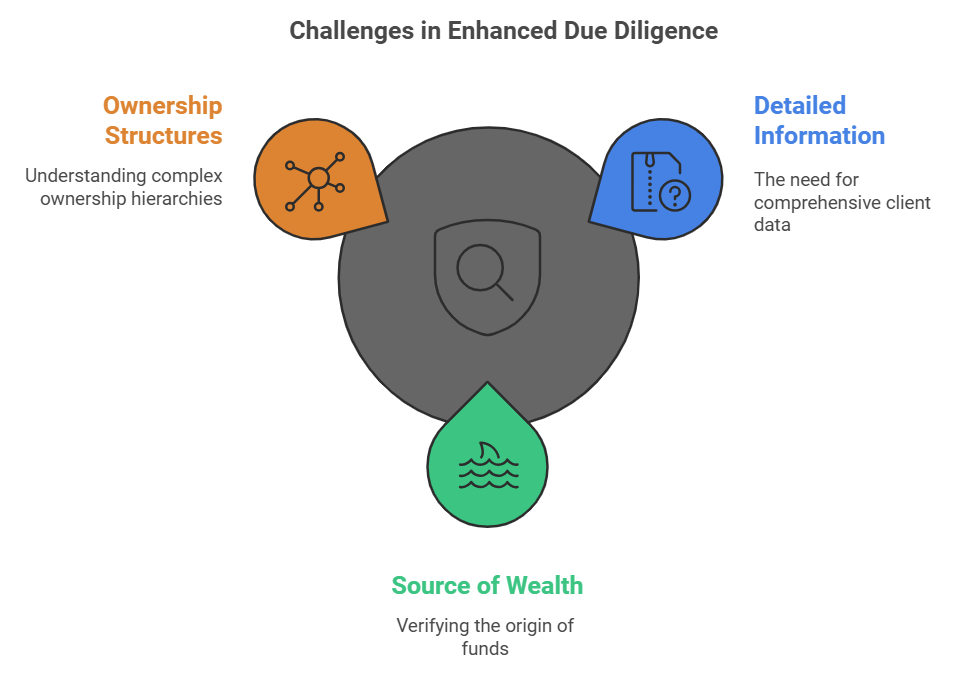

Challenges in Conducting Enhanced Due Diligence in the UAE

1. Complexity of Data Collection

One of the primary challenges of conducting EDD is the complexity involved in collecting and verifying detailed information about high-risk clients. The documentation required for verifying the source of wealth, ownership structures, and other factors can be extensive and time-consuming.

2. Limited Access to Information

In some cases, businesses may face challenges in accessing accurate information, particularly for clients from jurisdictions with limited transparency or inadequate regulatory frameworks. It is important for businesses to leverage third-party databases and verification tools to overcome these challenges and ensure that they have reliable information.

3. High Costs and Resource Allocation

EDD can be resource-intensive, requiring additional time, effort, and financial resources. Businesses need to allocate sufficient resources for conducting in-depth investigations, ongoing monitoring, and documentation. Despite the costs, EDD is necessary to mitigate potential financial and reputational risks.

Best Practices for Effective Enhanced Due Diligence

1. Utilize Advanced Technology for Monitoring

Leveraging advanced technology can significantly enhance the effectiveness of EDD. Automated monitoring tools, artificial intelligence (AI), and machine learning can help detect unusual patterns and potential risks more accurately and efficiently than manual processes.

2. Train Staff on EDD Requirements

Employees responsible for conducting EDD must be well-trained on regulatory requirements, red flags, and best practices. Regular training ensures that employees are well-equipped to identify suspicious activities, gather the necessary documentation, and follow the correct procedures.

Explore our AML Compliance Training Services for comprehensive training programs on EDD and AML compliance.

3. Engage External Compliance Experts

For businesses that lack the expertise or resources to conduct EDD effectively, engaging external compliance experts can be beneficial. Experienced consultants can provide the necessary guidance and support to ensure compliance with regulatory requirements.

4. Develop a Risk-Based Approach

Adopting a risk-based approach to EDD allows businesses to focus their resources on the clients and transactions that pose the highest risks. By categorizing customers based on their risk profiles, businesses can prioritize their efforts and take appropriate actions to mitigate potential risks.

Learn more about implementing a risk-based approach with our Risk Assessment Services.

How CAMC Can Assist with Enhanced Due Diligence

Chartered AML Consultants (CAMC) provides comprehensive EDD services to help businesses comply with UAE regulations and mitigate financial crime risks. Our services include:

1. EDD Policy Development

We assist businesses in developing EDD policies that align with regulatory requirements and international best practices. Our policies cover all aspects of customer identification, verification, risk assessment, and ongoing monitoring.

2. Background Screening and Verification

Our team conducts thorough background checks and verification of customer information to ensure compliance with regulatory standards. We use advanced tools to screen clients against sanctions lists, PEP lists, and adverse media databases.

3. Source of Wealth Verification

We provide assistance in verifying the source of wealth and funds, ensuring that businesses have reliable and accurate information about their high-risk clients. Our team works closely with clients to gather the necessary documentation and conduct in-depth investigations.

4. Ongoing Monitoring and Reporting

Our ongoing monitoring services help businesses keep track of high-risk clients and transactions. We provide regular updates, risk assessments, and support to ensure that businesses remain compliant with AML regulations.

Conclusion

Enhanced Due Diligence (EDD) is an essential component of AML compliance for businesses operating in the UAE. It provides a deeper level of scrutiny for high-risk clients, helping businesses mitigate financial crime risks, comply with regulatory requirements, and protect their reputation. By understanding the EDD process, implementing best practices, and leveraging expert support, businesses can effectively manage the risks associated with high-risk clients and ensure compliance with the UAE’s stringent AML regulations.

Partnering with CAMC can make the EDD process more efficient and effective. Our team of experts provides tailored EDD services to help businesses navigate the complexities of AML compliance and achieve their compliance objectives.

For more information on how CAMC can assist with enhanced due diligence, contact us today.

References

Basel Institute on Governance – AML Index

https://baselgovernance.org/basel-aml-index

United Arab Emirates Ministry of Finance – AML/CFT Guidelines

https://www.imf.org/external/np/leg/amlcft/eng

International Monetary Fund (IMF) – Combating Money Laundering and the Financing of Terrorism

https://www.imf.org/external/np/leg/amlcft/eng