The Evolution of Offshore Banking

Offshore banking has evolved far beyond its past image as an exclusive tool for the ultra-wealthy. Today, it’s a dynamic, regulated sector that demands careful navigation. Understanding its legitimate applications and potential pitfalls is critical for anyone considering this financial avenue.

Debunking Myths About Offshore Accounts

One of the biggest misconceptions about offshore banking is that it’s inherently linked to tax evasion. In reality, many people turn to offshore accounts for entirely valid reasons: protecting their wealth, enhancing financial privacy, or diversifying their investments across different markets. However, as concerns over financial crimes like money laundering grow, the importance of understanding the legal framework around offshore banking has never been greater. With governments tightening regulations worldwide, staying compliant is not optional—it’s essential.

Legal Foundations and Compliance Frameworks

Legally, offshore banking operates within stringent frameworks. Anti-money laundering (AML) and counter-terrorism financing (CTF) rules require financial institutions to implement robust Know Your Customer (KYC) and Customer Due Diligence (CDD) practices. These processes aim to identify risks and prevent misuse, but the reality is that financial crime continues to evolve. Staying proactive in combating such threats is non-negotiable for institutions and individuals alike.

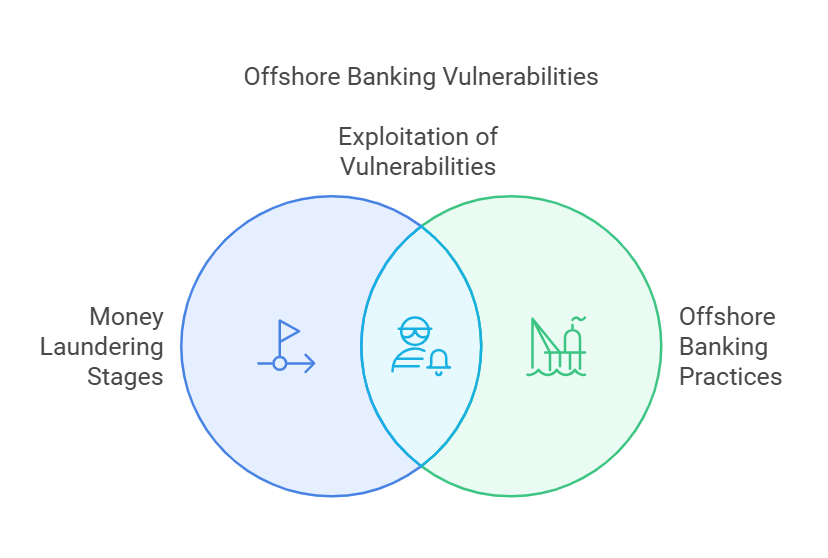

Understanding the Risks: Money Laundering Vulnerabilities

That said, the vulnerabilities of offshore banking can’t be ignored. Criminals often exploit certain stages of money laundering—like layering and integration—by using offshore accounts to obscure the origins of illicit funds. Shell companies and anonymous accounts exacerbate these risks, creating a fertile ground for unethical practices to flourish.

Technology’s Role in Shaping Financial Risks

Technology, while transformative, adds new layers of complexity. Innovations like decentralized finance (DeFi) and digital platforms in areas such as online gaming frequently lack the rigorous oversight that traditional banks maintain. These gaps leave room for exploitation by those seeking loopholes in compliance.

Addressing Regulatory Gaps and Global Initiatives

Regulatory shortfalls also persist. In the United States, for example, a longstanding issue has been the lack of immediate access to beneficial ownership data. However, efforts like FinCEN’s beneficial ownership information registry aim to address these weaknesses. Internationally, organizations like the Financial Action Task Force (FATF) continue to spotlight vulnerabilities, urging stricter enforcement to close compliance gaps.

Challenges for Offshore Banking Clients

For individuals exploring offshore banking, challenges abound. Volatile exchange rates, the ever-evolving web of regulations, and potential reputational risks tied to public perception are just a few factors to weigh carefully.

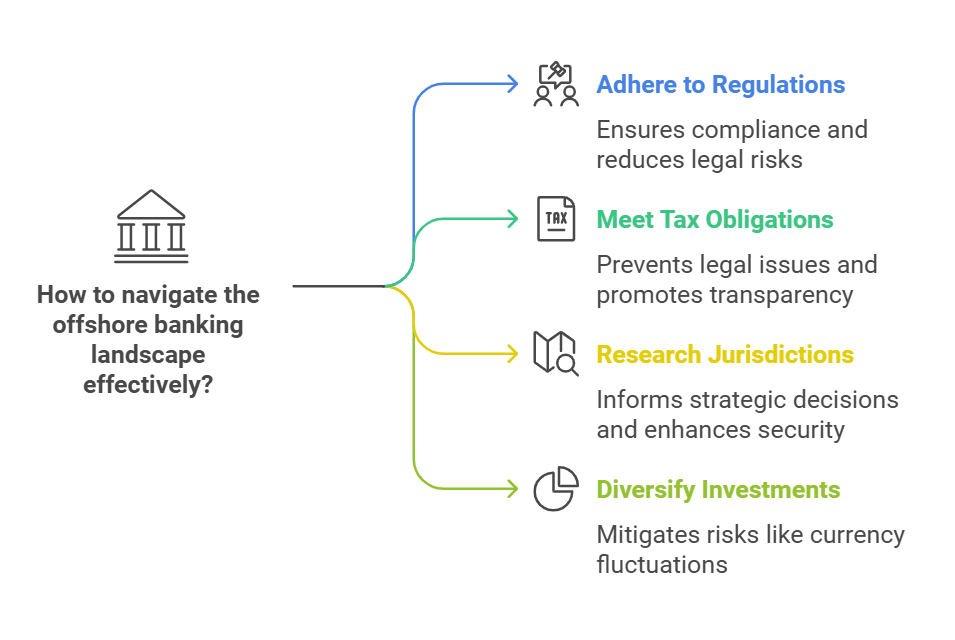

Strategies for Navigating the Offshore Banking Landscape

Navigating this complex terrain requires strategic planning. Adhering to AML and CTF regulations, meeting tax obligations, and researching the legal specifics of your chosen jurisdiction are crucial first steps. Transparency is key—not only does it protect your interests, but it also reinforces trust. Diversifying investments across multiple jurisdictions can help mitigate risks like currency fluctuations.

The Need for Caution and Informed Decisions

Ultimately, offshore banking can be a powerful financial tool—but it demands caution, diligence, and a commitment to compliance. As regulations become stricter and the financial landscape grows more intricate, staying informed is your best defense. By aligning your strategies with legal expectations, you can harness the benefits of offshore banking without falling into its potential pitfalls.