Evolving Financial Regulations and FATF’s Role

The landscape of financial regulations continues to shift, with a focus on combating money laundering and terrorist financing. The Financial Action Task Force (FATF) plays a crucial role in this effort by maintaining a grey list of jurisdictions under increased scrutiny for deficiencies in their anti-money laundering (AML) and counter-terrorism financing (CFT) measures. In October 2024, the FATF introduced significant updates to its grey list, marking a pivotal moment for global financial institutions and impacted nations.

Recent Additions to the Grey List

At the FATF’s October 2024 Plenary, four jurisdictions were newly added to the grey list:

- Algeria

- Angola

- Côte d’Ivoire

- Lebanon

These nations were flagged due to issues such as insufficient risk-based supervision, lack of transparency in beneficial ownership information, and weak AML/CFT enforcement measures. Despite these challenges, all four countries have pledged to work closely with the FATF to resolve their shortcomings.

Senegal’s Exit from the Grey List: A Success Story

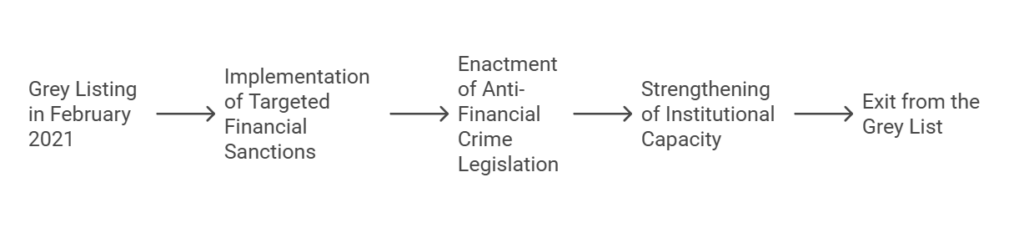

On the positive side, Senegal exited the grey list after demonstrating significant improvements in its AML/CFT frameworks. Since its grey listing in February 2021, Senegal has implemented targeted financial sanctions, enacted comprehensive anti-financial crime legislation, and strengthened its institutional capacity. This achievement highlights Senegal’s commitment to compliance and sets an example for other jurisdictions striving to improve their standing.

The Current State of the Grey List

The FATF grey list now includes 25 jurisdictions, each required to undertake substantial reforms to meet global AML/CFT standards. Financial institutions operating within or interacting with these jurisdictions must exercise heightened vigilance. Rigorous due diligence processes and a deep understanding of the specific risks in these regions are essential to avoid regulatory penalties and reputational damage.

Implications for Financial Institutions

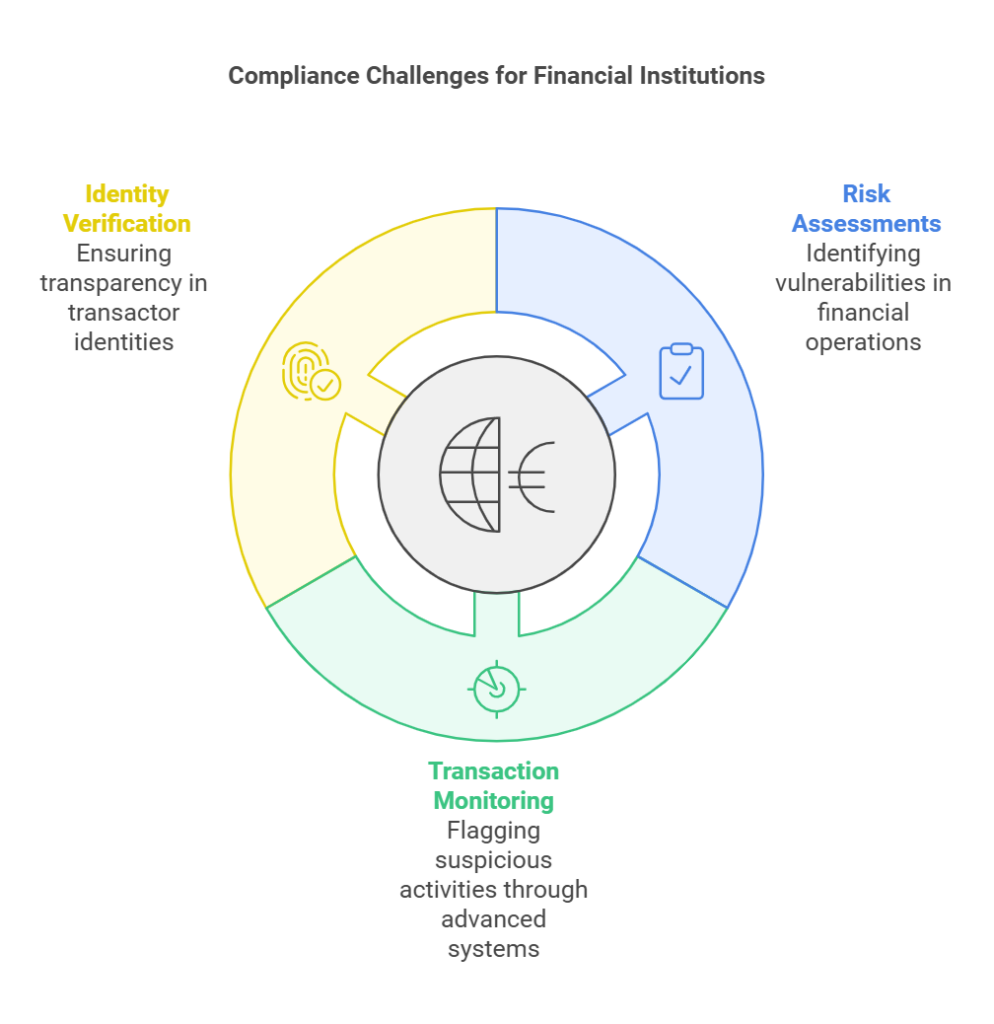

Engagement with grey-listed jurisdictions presents several challenges, particularly for institutions in highly regulated markets like the United States. Key compliance measures include:

- Conducting detailed risk assessments to identify vulnerabilities.

- Implementing advanced transaction monitoring systems to flag suspicious activities.

- Verifying the identities of transactors and ensuring transparency in beneficial ownership records.

Failing to comply with these requirements can lead to serious regulatory and operational consequences, as well as reputational harm.

Revisions to Grey-Listing Criteria

The FATF is evolving its grey-listing criteria to better accommodate low-capacity nations. Countries with financial assets under $10 billion or classified as least developed by the UN may be granted up to two years to address their AML/CFT deficiencies before being formally grey-listed. This approach provides these nations with an opportunity to strengthen their compliance frameworks without facing immediate penalties, reflecting a more equitable and supportive regulatory environment.

Future Guidance and Developments

Looking ahead, the FATF plans to refine its standards to better balance financial inclusion with AML/CFT obligations. Upcoming guidelines will provide financial institutions operating in low-risk environments with simplified compliance measures. For resource-constrained nations, new tools and frameworks will be introduced to support risk assessments and enhance compliance capabilities. These updates, slated for 2025, aim to transform the global fight against financial crime while supporting financial inclusion.

Conclusion

The October 2024 FATF grey list updates underscore the organization’s dual mission of enhancing financial integrity and supporting developing nations in meeting compliance standards. For financial institutions, adapting to these changes will require vigilance, robust due diligence, and a proactive understanding of evolving regulatory expectations. By embracing these principles, organizations can successfully navigate the complexities of the grey list and maintain their commitment to global financial integrity.