Introduction

In today’s global financial environment, the need for stringent anti-money laundering (AML) measures is greater than ever. One of the most vital tools in the fight against financial crime is Enhanced Due Diligence (EDD). EDD is an important part of AML frameworks, especially when dealing with high-risk clients and transactions. It goes beyond standard customer due diligence (CDD) to ensure that financial institutions have a deep understanding of their customers, their business activities, and the potential risks they may pose.

This blog delves into the meaning of EDD, its significance, and how it is applied in AML practices to safeguard financial institutions and ensure regulatory compliance.

What is Enhanced Due Diligence (EDD)?

Enhanced Due Diligence (EDD) refers to the additional steps that financial institutions and other regulated entities take to verify the identity of their high-risk clients. Unlike standard Customer Due Diligence (CDD), EDD involves a more in-depth assessment, focusing on collecting comprehensive information about the customer’s identity, business activities, and the source of their funds. This heightened level of scrutiny is crucial in preventing money laundering, terrorist financing, and other forms of financial crime.

EDD is typically applied in cases where a client or transaction poses a higher-than-usual risk. Examples include clients from high-risk jurisdictions, politically exposed persons (PEPs), and transactions involving large sums of money with unclear origins.

Explore our Customer Due Diligence Services to learn more about how CAMC can help your business manage high-risk clients effectively.

Why is Enhanced Due Diligence Important?

1. Managing High-Risk Clients

Not all customers pose the same level of risk to a financial institution. High-risk clients, such as PEPs or those involved in complex transactions, require additional scrutiny to mitigate the risk of money laundering. By applying EDD measures, financial institutions can obtain a deeper understanding of these clients, thereby identifying potential red flags early in the relationship.

Learn more about PEP verification through our PEP Verification Services.

2. Regulatory Compliance

The Financial Action Task Force (FATF) has established international standards that require financial institutions to implement EDD for high-risk customers. Compliance with these standards is essential to avoid regulatory penalties and reputational damage. In the UAE, the Central Bank and other regulatory bodies have established strict guidelines for EDD, making it a crucial component of any AML compliance program.

Learn more about our AML/CFT Policies to understand how CAMC helps businesses align with regulatory requirements.

3. Prevention of Money Laundering and Terrorist Financing

EDD is a vital tool for detecting and preventing money laundering and terrorist financing activities. By thoroughly assessing the customer’s background, source of wealth, and transaction patterns, financial institutions can identify suspicious activities and report them to the Financial Intelligence Unit (FIU) before they cause significant harm to the financial system.

Explore our AML/CFT Regulatory Reporting Services to learn more about how we help businesses in their reporting obligations.

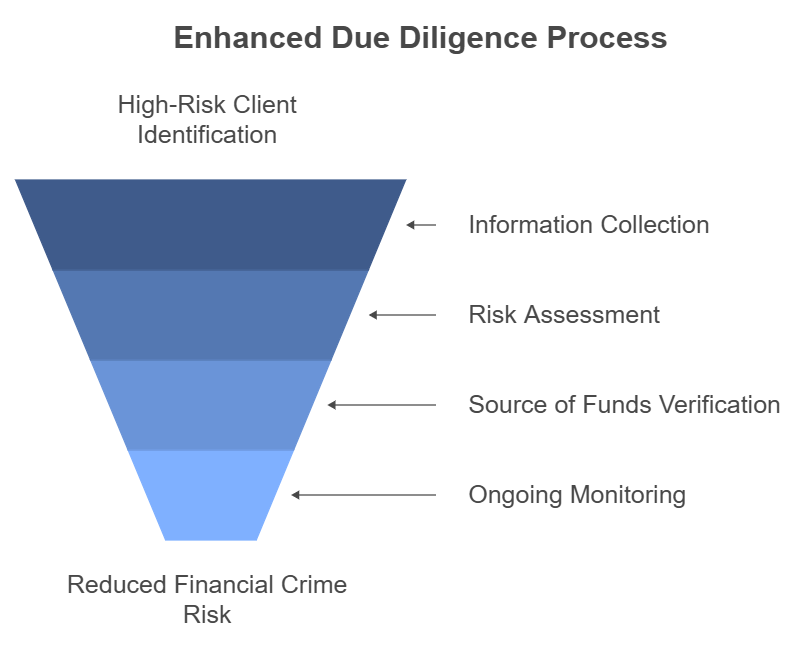

Key Elements of Enhanced Due Diligence

1. Collecting Comprehensive Customer Information

The first step in EDD is to collect extensive information about the customer. This includes gathering documents to verify the identity of the customer, their business activities, and their source of funds. For high-risk clients, this may involve obtaining additional documentation, such as proof of ownership, audited financial statements, and details about beneficial owners.

Learn more about our KYC and Customer Due Diligence Services to ensure your business is prepared for any customer risk.

2. Verifying the Source of Funds and Wealth

A key aspect of EDD is verifying the customer’s source of funds and wealth. This involves tracing the origin of the money being used in a transaction and ensuring that it is from a legitimate source. This process can involve reviewing financial statements, contracts, and other supporting documents to validate the legitimacy of the funds.

3. Continuous Monitoring

EDD does not end once a customer is onboarded. Financial institutions must continuously monitor high-risk clients to detect any changes in their behavior that could indicate suspicious activities. This involves scrutinizing transactions in real-time, flagging unusual patterns, and conducting regular reviews of the customer’s risk profile.

Explore our Ongoing Transaction Monitoring Services to stay proactive in monitoring customer activities.

4. Identifying Politically Exposed Persons (PEPs)

PEPs are individuals who hold prominent public positions or have close connections with such individuals, making them more susceptible to corruption and money laundering. Identifying PEPs is an essential part of EDD, and financial institutions must take extra precautions when dealing with them. This includes conducting detailed background checks and ongoing monitoring to identify any potential risks.

Learn more about our Sanctions Screening and PEP Verification Services to ensure compliance.

5. Detailed Risk Assessment

A comprehensive risk assessment is at the heart of EDD. Financial institutions need to evaluate all aspects of a customer’s profile, including their geographic location, type of business, and historical transactions. This allows institutions to assign risk ratings to each customer and decide on the appropriate level of due diligence required. High-risk clients will need additional scrutiny, including a deeper examination of their financial dealings and background.

When Should EDD be Applied?

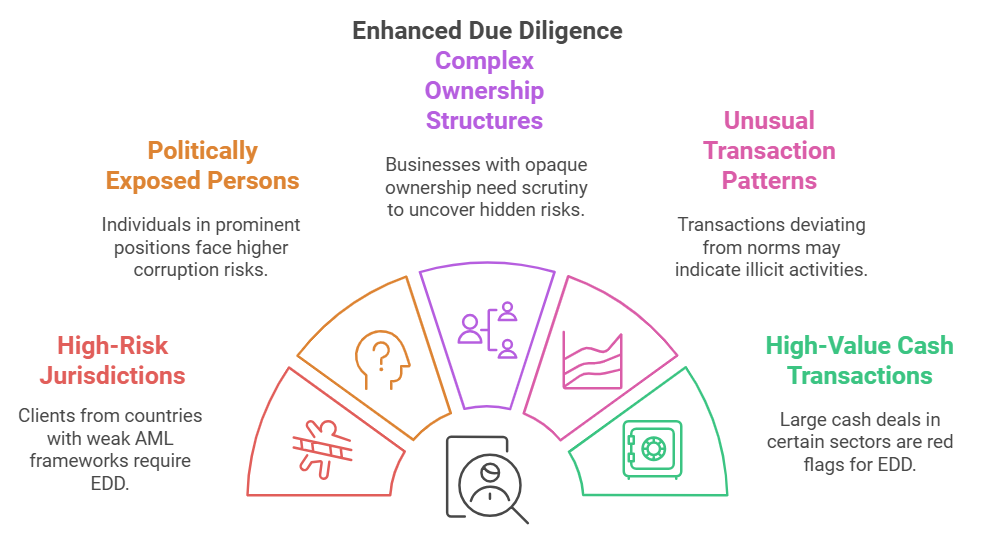

EDD is not required for every client, but rather in situations where the risk of money laundering or terrorist financing is significantly higher. Below are common scenarios where EDD should be applied:

- High-Risk Jurisdictions: Clients from countries identified by the FATF as having strategic deficiencies in their AML frameworks are subject to EDD.

- Politically Exposed Persons (PEPs): Clients who hold or have held prominent public positions require EDD due to the higher risk of corruption.

- Complex Ownership Structures: Businesses with complex or non-transparent ownership structures may require EDD to ensure that there are no hidden beneficiaries with criminal intent.

- Unusual Transaction Patterns: Clients whose transactions are inconsistent with their stated business profile or involve unusually large amounts may warrant enhanced due diligence.

- High-Value Cash Transactions: Transactions involving unusually large amounts of cash, particularly in sectors like real estate, luxury goods, or gambling, are red flags that require enhanced scrutiny.

- Cross-Border Transactions: Clients engaging in frequent cross-border transactions, especially with high-risk jurisdictions, should be subject to EDD to ensure these activities are legitimate.

Challenges in Implementing Enhanced Due Diligence

1. Difficulty in Accessing Accurate Information

One of the biggest challenges in conducting EDD is accessing accurate and up-to-date information about customers. High-risk clients often attempt to hide their true identity or the origin of their funds, making it challenging for financial institutions to verify their legitimacy. This challenge can be mitigated by using reliable third-party verification services and maintaining access to updated databases.

2. Resource-Intensive Process

EDD is more resource-intensive compared to standard due diligence. It involves collecting extensive documentation, verifying information, and ongoing monitoring of high-risk clients. Financial institutions must ensure that they have the necessary resources and trained personnel to conduct EDD effectively without compromising on customer service.

Explore our Compliance Training Services to ensure your team is ready to handle EDD requirements.

3. Balancing Customer Experience with Compliance

While EDD is crucial for regulatory compliance, it can create friction in the customer onboarding process, especially for high-net-worth clients. Financial institutions must balance the need for thorough due diligence with providing a seamless customer experience. Implementing efficient and automated processes can help mitigate this challenge.

4. Complexity of Global Regulations

EDD compliance is complicated by the fact that regulations differ significantly between jurisdictions. Financial institutions operating across borders need to be aware of the specific EDD requirements in each country where they operate. This requires considerable time and effort to stay updated on changes in local and international regulations.

5. Identifying Ultimate Beneficial Ownership (UBO)

One of the challenges with EDD is identifying the ultimate beneficial owners of a business. Criminals often hide their identities behind complex corporate structures, making it difficult to determine who truly owns or controls a company. Institutions must be diligent in gathering sufficient information to identify these individuals and verify their legitimacy.

Best Practices for Effective EDD Implementation

1. Develop a Risk-Based Approach

Implementing a risk-based approach allows financial institutions to allocate resources where they are needed the most. High-risk clients require enhanced scrutiny, while lower-risk clients can be subject to standard due diligence. This helps institutions manage their resources effectively and focus on areas that pose the highest risk.

2. Leverage Technology for Data Collection and Monitoring

Using technology for data collection and monitoring can significantly enhance the efficiency of EDD processes. Automated tools and AI-driven compliance solutions can help collect customer data, verify information, and monitor transactions in real-time. These tools also help in flagging unusual patterns and generating alerts for further investigation.

3. Regularly Update EDD Policies

Financial institutions must regularly update their EDD policies to keep pace with evolving regulations and emerging threats. This includes conducting periodic reviews of EDD procedures, updating risk assessment frameworks, and ensuring that employees are trained on any changes to compliance requirements.

Explore our Comprehensive AML/CFT Policies to strengthen your compliance measures.

4. Employee Training and Awareness

Well-trained employees are essential for effective EDD implementation. Financial institutions must invest in regular training programs to educate their employees on red flags, regulatory requirements, and how to identify suspicious activities. This helps in creating a culture of compliance and ensures that all staff members are aware of their responsibilities.

Explore our AML Compliance Training Services for tailored training programs that help employees understand EDD requirements and their role in the process.

5. Collaborate with Compliance Experts

Engaging compliance experts can provide valuable guidance in implementing effective EDD measures. Experts can help in designing risk assessment frameworks, developing EDD policies, and providing specialized training to compliance officers. External expertise ensures that your EDD processes are comprehensive and up-to-date with the latest regulatory requirements.

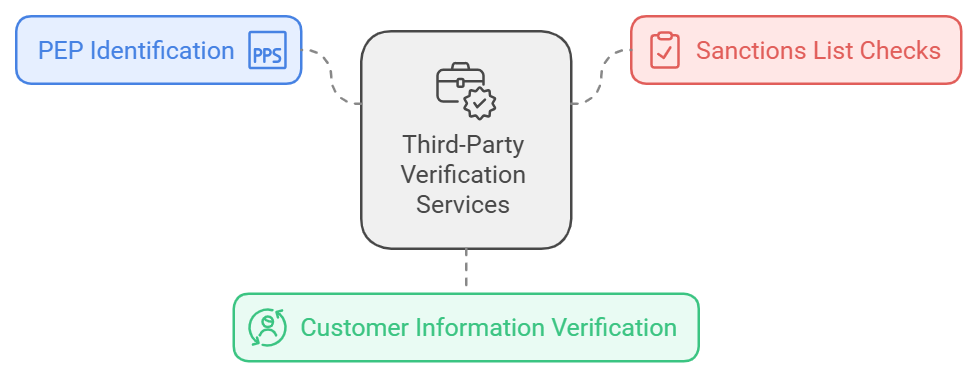

6. Use of Third-Party Verification Services

To streamline the verification process, institutions can utilize third-party verification services that specialize in identifying PEPs, verifying customer information, and checking against sanctions lists. These services provide reliable, up-to-date data, reducing the workload on internal compliance teams. By outsourcing these verification processes to trusted third parties, financial institutions can ensure that customer information is accurate and compliant with regulations.

Third-party verification services can also help monitor changes in the status of clients, such as new adverse media or changes in PEP status, ensuring continuous compliance. By leveraging the expertise and technology of these service providers, financial institutions can focus on core business activities while maintaining a robust EDD process.

How CAMC Can Assist with Enhanced Due Diligence

Chartered AML Consultants (CAMC) offers comprehensive services to help businesses meet their Enhanced Due Diligence (EDD) requirements. Our services include:

1. Tailored EDD Solutions

We provide customized EDD solutions based on the risk profile of your clients. Whether you need assistance with high-risk customer onboarding, transaction monitoring, or verifying the source of funds, CAMC has the expertise to help.

2. PEP and Sanctions Screening

Our PEP and sanctions screening services help identify high-risk clients and ensure compliance with international regulations. We use advanced verification tools to assess customer risk accurately and provide ongoing monitoring to detect any changes.

3. In-Depth Risk Assessments

Our risk assessment services help businesses identify and categorize clients based on their risk levels. By understanding each client’s risk profile, you can apply appropriate due diligence measures to mitigate the risk of financial crime.

4. Training and Capacity Building

CAMC offers training programs designed to educate employees on EDD requirements, red flags, and reporting obligations. Our programs include real-life case studies, interactive workshops, and assessments to ensure employees are well-prepared to handle high-risk clients.

Explore our Expert AML Risk Assessment Services to learn more about how CAMC can assist in risk management and compliance.

Conclusion

Enhanced Due Diligence (EDD) is a crucial component of any AML compliance program, especially when dealing with high-risk clients and transactions. By implementing EDD, financial institutions can ensure they have a deep understanding of their clients, their business activities, and the associated risks, thereby reducing the likelihood of financial crime.

CAMC is committed to helping businesses navigate the complexities of EDD. Our range of services—from PEP screening to in-depth risk assessments and tailored training programs—ensures that businesses are well-equipped to meet regulatory requirements and mitigate the risks associated with high-risk clients.

For more information on how CAMC can assist your business with EDD compliance, contact us today. Stay ahead in the fight against money laundering and ensure your organization remains compliant with UAE regulations.

References:

OECD – Politically Exposed Persons (PEPs) in AML

https://www.oecd.org/corruption/anti-bribery/PEPs-in-AML

Basel Institute on Governance – AML Index

https://baselgovernance.org/basel-aml-index

United Arab Emirates Ministry of Finance – AML/CFT Guidelines

https://www.mof.gov.ae/en/resourcesAndBudget/Pages/aml-cft.aspx

International Monetary Fund (IMF) – Combating Money Laundering and the Financing of Terrorism

https://www.imf.org/external/np/leg/amlcft/eng