Introduction

In the modern financial landscape, protecting the integrity of financial systems is of utmost importance. One of the key elements in this fight is Counter Financing of Terrorism (CFT), which is aimed at preventing the misuse of funds for terrorist activities. The UAE, being a major global financial hub, has taken significant steps to ensure compliance with international standards on CFT to prevent any misuse of its financial systems for terrorism-related financing.

This blog explores the meaning of CFT, why it is crucial, and how businesses can ensure compliance with UAE regulations to contribute to global financial security.

What is Counter Financing of Terrorism (CFT)?

Counter Financing of Terrorism (CFT) refers to the measures and regulations that financial institutions, businesses, and countries implement to prevent, detect, and stop the funding of terrorist activities. CFT works in tandem with Anti-Money Laundering (AML) initiatives, as both frameworks are crucial in the effort to identify and thwart financial activities that support illegal or harmful behaviors.

CFT focuses specifically on preventing the flow of money that may be used to finance terrorist organizations or activities. This can involve the identification of suspicious transactions, enhanced due diligence for high-risk clients, and increased monitoring of financial dealings involving individuals or entities linked to terrorist groups.

Why is CFT Compliance Important in the UAE?

1. Alignment with International Standards

The Financial Action Task Force (FATF) has established recommendations and guidelines that nations must adhere to in order to combat terrorism financing effectively. The UAE, as a member of FATF, has implemented strict CFT regulations to align itself with these international standards. Compliance with CFT requirements not only protects the nation’s financial reputation but also ensures that it remains an attractive destination for foreign investments.

Explore our AML Compliance Services to understand how CAMC can help you stay compliant.

2. Protecting Financial Institutions

Financial institutions are particularly vulnerable to the risk of misuse for financing terrorism. By ensuring CFT compliance, businesses can protect themselves from being unwittingly involved in terrorist financing activities. Compliance involves implementing robust Customer Due Diligence (CDD) processes, monitoring transactions, and reporting any suspicious activity to regulatory authorities.

Learn more about CDD through our Customer Due Diligence Services.

3. Risk Mitigation and Regulatory Penalties

Failure to comply with CFT regulations can result in severe financial and reputational consequences. Businesses may face hefty fines, legal action, and restrictions if they are found to be non-compliant. Moreover, the reputational damage associated with being linked to terrorism financing is significant and can have long-lasting impacts.

The UAE has implemented strict penalties for businesses that fail to comply with CFT regulations, making it essential for all entities to understand and implement these measures effectively.

Key Elements of CFT Compliance

1. Customer Due Diligence (CDD)

CDD is an essential part of CFT compliance. Businesses must identify their customers, verify their identities, and assess the risk they may pose in terms of terrorism financing. This includes collecting personal information such as identification documents and conducting background checks.

For high-risk clients, Enhanced Due Diligence (EDD) should be applied, which involves gathering more detailed information about the client, including their source of funds and wealth. This is especially important for clients from high-risk jurisdictions or those flagged by international sanctions lists.

Explore more about EDD through our Enhanced Due Diligence Services.

2. Ongoing Transaction Monitoring

Ongoing transaction monitoring is crucial for detecting any suspicious activity that could indicate the financing of terrorism. Financial institutions must monitor transactions in real time and flag any unusual or potentially risky activities for further investigation. This monitoring must be conducted continuously to ensure that any changes in customer behavior are detected promptly.

3. Screening Against Sanctions Lists

Businesses must screen clients against international sanctions lists and Politically Exposed Persons (PEP) lists to identify any individuals or entities that pose a higher risk of involvement in terrorism financing. This screening process helps identify clients who are subject to international sanctions or are linked to terrorist organizations.

Explore our Sanctions Screening and Verification Services for more information on how CAMC can help.

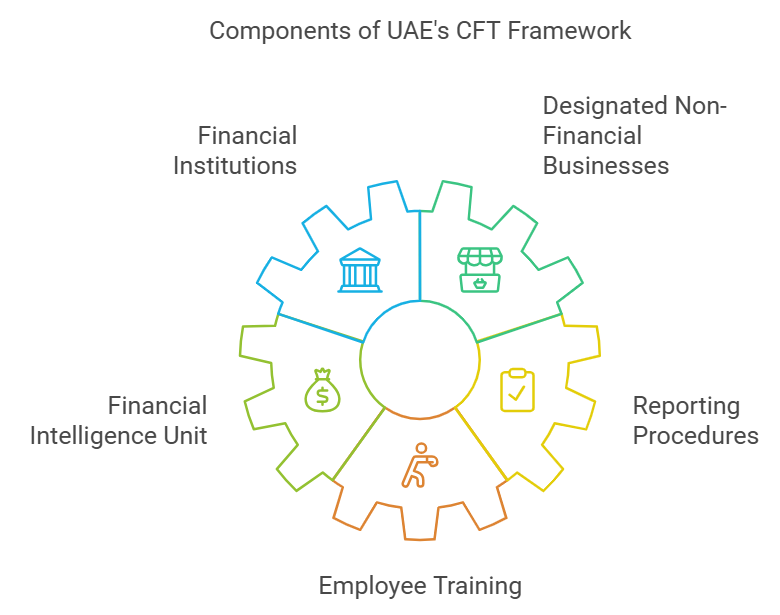

4. Reporting Suspicious Activities

In the UAE, all financial institutions and designated non-financial businesses are required to report any Suspicious Activity Reports (SARs) or Suspicious Transaction Reports (STRs) to the Financial Intelligence Unit (FIU). These reports are critical for identifying potential terrorism financing activities and are a key part of the UAE’s CFT framework.

Businesses must establish clear procedures for identifying and reporting suspicious activities, and employees should be trained to recognize red flags that may indicate the possibility of terrorism financing.

5. Employee Training and Awareness

Effective CFT compliance requires well-trained employees who understand the risks associated with terrorism financing and are able to identify and report suspicious activities. Regular training programs should be conducted to educate employees on CFT requirements, red flags, and the steps they need to take to comply with UAE regulations.

Explore our AML Compliance Training Services to learn more about how we can help train your employees.

Challenges in CFT Compliance

1. Complex and Evolving Regulations

One of the primary challenges businesses face when ensuring CFT compliance is the complexity and constant evolution of regulations. The regulatory landscape is continuously changing, and businesses must keep up with these changes to remain compliant. This requires regular updates to internal policies and procedures and ensuring that employees are trained on the latest requirements.

2. Identifying and Managing High-Risk Clients

Identifying high-risk clients and determining whether they pose a terrorism financing risk can be challenging. High-risk clients, such as PEPs or those from high-risk jurisdictions, require enhanced scrutiny and ongoing monitoring. This process can be resource-intensive, and businesses must ensure they have adequate systems and personnel in place to manage these risks effectively.

3. Access to Accurate Information

Businesses often face difficulties accessing accurate and reliable information about customers, particularly those from jurisdictions with limited transparency. This can hinder effective customer screening and due diligence. To overcome this challenge, businesses must leverage third-party databases, verification tools, and external compliance experts to ensure that they have reliable information about their clients.

4. Balancing Compliance with Customer Experience

While CFT compliance is essential for mitigating the risk of terrorism financing, it can sometimes create friction in the customer onboarding process. Businesses must balance the need for thorough due diligence with providing a seamless customer experience. Excessive documentation requests or lengthy verification processes can lead to customer dissatisfaction and hinder business growth.

Best Practices for Effective CFT Compliance

1. Develop a Risk-Based Approach

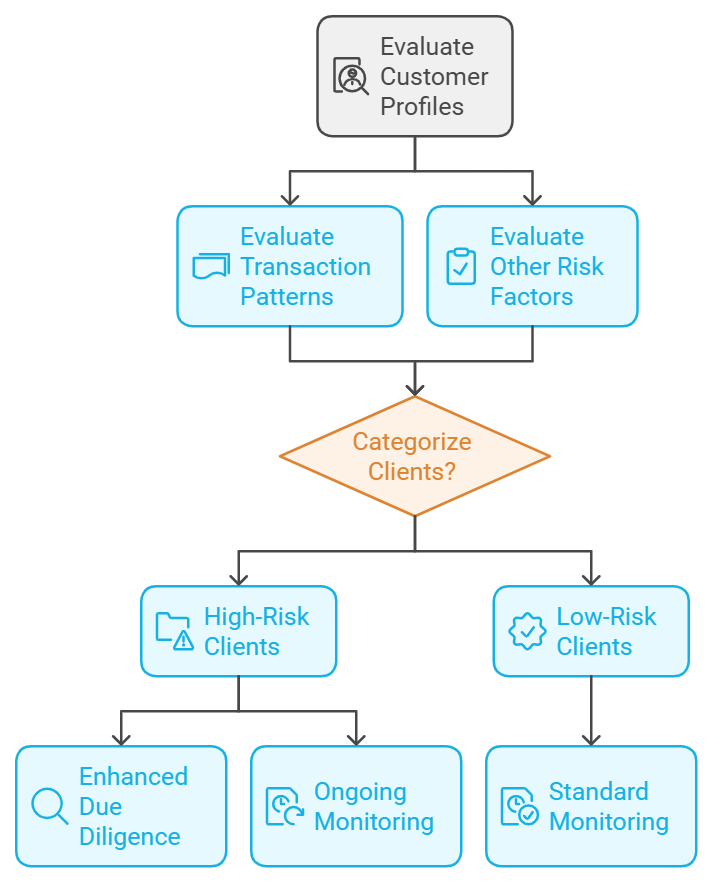

A risk-based approach to CFT compliance is essential for allocating resources effectively. High-risk clients and transactions require enhanced due diligence, while lower-risk clients may be subject to standard due diligence procedures. By categorizing clients based on their risk profiles, businesses can focus their resources on areas that pose the highest risk of terrorism financing.

2. Leverage Technology for Monitoring

Automated monitoring tools and AI-driven compliance solutions can significantly enhance the effectiveness of CFT compliance. These tools help businesses monitor customer activities in real-time, detect unusual patterns, and flag potential risks more efficiently than manual processes. Automated systems also help reduce human error and improve the speed at which suspicious activities are identified and reported.

3. Regularly Update Policies and Procedures

Businesses must regularly update their internal policies and procedures to ensure compliance with evolving CFT regulations. This includes conducting periodic reviews of CFT policies, updating risk assessment frameworks, and ensuring that employees are trained on any changes to compliance requirements. Regular updates are crucial for staying ahead of emerging threats and maintaining compliance.

4. Engage External Compliance Experts

Engaging external compliance experts can help businesses navigate the complexities of CFT compliance. Compliance consultants provide specialized knowledge and guidance to ensure that businesses meet regulatory requirements and implement best practices for preventing terrorism financing. External experts can also conduct independent reviews of existing CFT practices and recommend improvements to enhance compliance.

Explore our Expert AML Risk Assessment Services for more information on how CAMC can help your business stay compliant.

5. Maintain Comprehensive Records

Maintaining comprehensive records of all CFT-related activities is essential for demonstrating compliance with regulatory requirements. Businesses must keep detailed records of customer identification, risk assessments, transaction monitoring, and any red flags identified during the due diligence process. These records should be easily accessible for review by regulatory authorities and must be updated regularly.

How CAMC Can Assist with CFT Compliance

Chartered AML Consultants (CAMC) provides comprehensive CFT compliance services to help businesses meet UAE regulations and mitigate terrorism financing risks. Our services include:

1. CFT Policy Development

We assist businesses in developing CFT policies that align with regulatory requirements and international best practices. Our policies cover all aspects of customer identification, risk assessment, transaction monitoring, and reporting of suspicious activities.

2. Customer Screening and Verification

Our team conducts thorough screening and verification of customers against international sanctions lists, PEP lists, and adverse media to ensure compliance with CFT regulations. We use advanced verification tools to accurately assess customer risk and identify any potential red flags. This process helps prevent businesses from onboarding individuals or entities that may be involved in financing terrorism.

3. Risk Assessment and Categorization

CAMC offers in-depth risk assessment services to help businesses categorize clients based on their risk profiles. By identifying high-risk clients, businesses can apply enhanced due diligence measures and ongoing monitoring to mitigate the risks of terrorism financing. Our risk assessment process includes evaluating customer profiles, transaction patterns, and other risk factors to provide a comprehensive view of each client’s risk level.

4. Ongoing Transaction Monitoring

We assist businesses in setting up and maintaining effective transaction monitoring systems that help detect suspicious activities in real time. Our team provides guidance on implementing automated monitoring tools that can flag unusual transactions for further investigation, helping businesses stay compliant with UAE CFT regulations. This ongoing monitoring process is crucial for identifying any changes in customer behavior that may indicate potential terrorism financing.

5. Employee Training Programs

Effective compliance requires knowledgeable employees who understand the risks of terrorism financing and are able to identify and report suspicious activities. CAMC offers tailored training programs to educate employees on CFT requirements, red flags, and reporting procedures. Our training sessions include real-life case studies, interactive workshops, and assessments to ensure that employees are well-prepared to contribute to the company’s compliance efforts.

6. Assistance with Reporting Suspicious Activities

Our team helps businesses establish clear procedures for reporting Suspicious Activity Reports (SARs) and Suspicious Transaction Reports (STRs) to the relevant authorities. We provide guidance on identifying suspicious activities, completing the necessary documentation, and ensuring that reports are submitted in a timely manner. By ensuring that businesses have the proper reporting procedures in place, CAMC helps reduce the risk of penalties for non-compliance.

7. Independent Compliance Audits

To ensure that your business remains compliant with CFT regulations, CAMC conducts independent compliance audits. These audits involve reviewing existing CFT practices, identifying areas for improvement, and recommending actionable steps to enhance compliance. Our audits provide businesses with an objective assessment of their CFT procedures and help identify any gaps or areas that require improvement.

8. Ongoing Compliance Support

CAMC provides ongoing compliance support to help businesses keep pace with evolving regulations and maintain robust CFT frameworks. Our team offers regular consultations, updates on regulatory changes, and proactive recommendations to ensure that businesses remain compliant at all times. By partnering with CAMC, businesses can rest assured that they have expert guidance at every step of their compliance journey.

Explore our AML/CFT Compliance Training Services to learn how we can help train your employees and support your compliance journey. Additionally, you can find out more about our Comprehensive AML/CFT Policies to strengthen your CFT measures.

Conclusion

Counter Financing of Terrorism (CFT) is a critical component in protecting the integrity of the financial system and ensuring that terrorist activities are not financed through misuse of financial channels. Compliance with CFT regulations is essential for businesses operating in the UAE, particularly in high-risk sectors, and requires ongoing efforts in customer due diligence, monitoring, and reporting suspicious activities.

CAMC is committed to helping businesses navigate the complexities of CFT compliance. Our range of services—from policy development to employee training and compliance audits—ensures that businesses are well-equipped to meet regulatory requirements and mitigate the risks associated with terrorism financing.

For more information on how CAMC can assist your business with CFT compliance, contact us today. Stay ahead in the fight against terrorism financing and ensure your organization is contributing to a safe and secure financial environment.

References:

AML/CFT Policies – CAMC

https://camc.ae/services/comprehensive-aml-cft-policy-in-uae/

Financial Conduct Authority (FCA) – AML Guidance

https://www.fca.org.uk/firms/financial-crime/aml

United Nations Office on Drugs and Crime – Anti-Money Laundering

https://www.unodc.org/unodc/en/money-laundering/index.html

OECD – Politically Exposed Persons (PEPs) in AML

https://www.oecd.org/corruption/anti-bribery/PEPs-in-AML

Basel Institute on Governance – AML Index

https://baselgovernance.org/basel-aml-index