Introduction

In the ever-evolving landscape of financial regulations, the United Arab Emirates has taken significant strides to combat money laundering and terrorist financing. At the heart of these efforts lies Customer Due Diligence (CDD), a process that is both complex and indispensable. CDD is not just a regulatory requirement; it forms the cornerstone of Anti-Money Laundering (AML) compliance in the UAE. This blog delves into the intricacies of CDD and its vital role in safeguarding the integrity of the financial sector, while also highlighting how CAMC can assist in achieving compliance excellence.

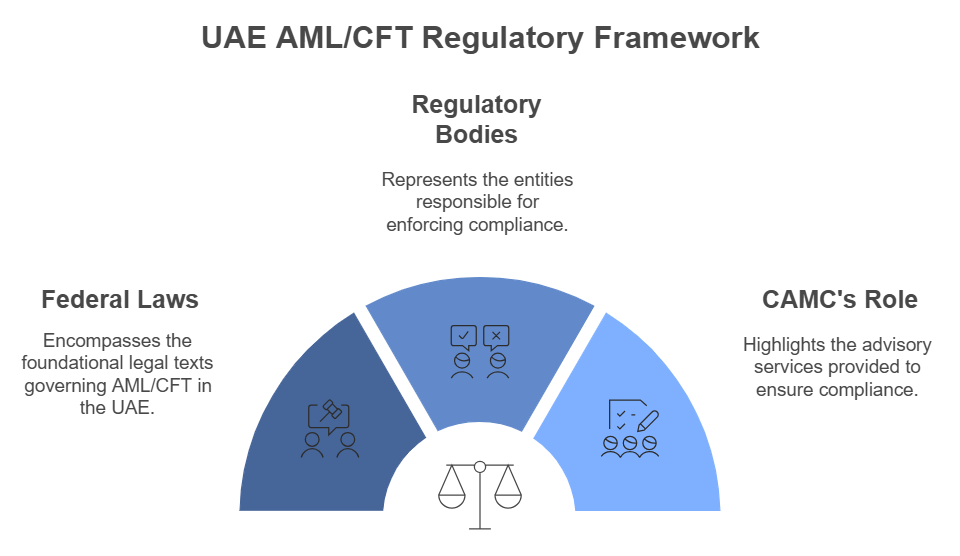

Comprehend the Regulatory Framework:

To fully grasp the importance of Customer Due Diligence, one must first understand the regulatory framework governing AML compliance in the UAE. The nation’s AML/CFT regulations are structured by Federal Decree-Law No. 20 of 2018, amended by Federal Decree Law No. 26 of 2021, and supported by Cabinet Decision No. 10 of 2019 along with subsequent resolutions. These laws align with global standards set by the Financial Action Task Force (FATF) and are enforced by numerous regulatory bodies, including the Central Bank of the UAE (CBUAE), the Financial Intelligence Unit (FIU), and the Securities and Commodities Authority (SCA).

CAMC’s Role: CAMC offers comprehensive advisory services to help financial institutions and businesses navigate this complex regulatory environment, ensuring they are fully compliant with both local and international standards.

Establish Risk-Based Protocols:

Establishing risk-based protocols is a fundamental aspect of effective CDD. Financial institutions must implement these protocols to identify, verify, and assess the risk profile of customers. This process involves understanding the nature of the customer’s business, identifying beneficial owners, and verifying customer information using independent, reliable sources.

CAMC’s Role: CAMC can assist in developing tailored risk assessment frameworks that are aligned with regulatory expectations, enabling institutions to manage customer risks effectively.

Customer Identification and Verification:

Customer identification and verification are critical steps in the CDD process. This entails collecting essential information from customers, including legal form, headquarters’ office address, and the names of senior management. Verification should be performed using independent, reliable sources to ensure the integrity of the data.

CAMC’s Role: CAMC provides best-in-class solutions for verifying customer information, leveraging cutting-edge technology to ensure accuracy and compliance.

Assess and Understand Customer Risk:

Evaluating the risk level associated with customers involves considering factors such as business type, nationality, political exposure, and transaction modes. This assessment is crucial for determining the appropriate level of due diligence required.

CAMC’s Role: CAMC offers tools and methodologies for assessing customer risk, helping institutions to categorize clients appropriately and apply suitable due diligence measures.

Execute Advanced Due Diligence Procedures:

For high-risk customers, such as Politically Exposed Persons (PEPs) or those from high-risk countries, enhanced due diligence procedures are necessary. This may include collecting additional information, conducting site visits, or employing external agencies.

CAMC’s Role: CAMC specializes in conducting robust due diligence investigations, providing detailed reports and actionable insights for managing high-risk customer relationships effectively.

Maintain Ongoing Monitoring:

Continuous monitoring of customer accounts and transactions is vital. This includes periodic reviews of customer information and scrutinizing transaction patterns to identify unusual activities. Advanced analytics can be employed to enhance the detection of suspicious behavior.

CAMC’s Role: CAMC implements state-of-the-art monitoring systems that facilitate real-time analysis and alert institutions to potential anomalies, thereby enhancing compliance and reducing risk.

Educate Employees and Increase Awareness:

Training employees on CDD procedures and maintaining accurate records of all CDD activities are essential components of an institution’s compliance framework. Strong reporting mechanisms for suspicious activity reports (SARs) should also be in place.

CAMC’s Role: CAMC provides comprehensive training programs and workshops to ensure all staff members are well-versed in CDD practices and can effectively contribute to risk management efforts.

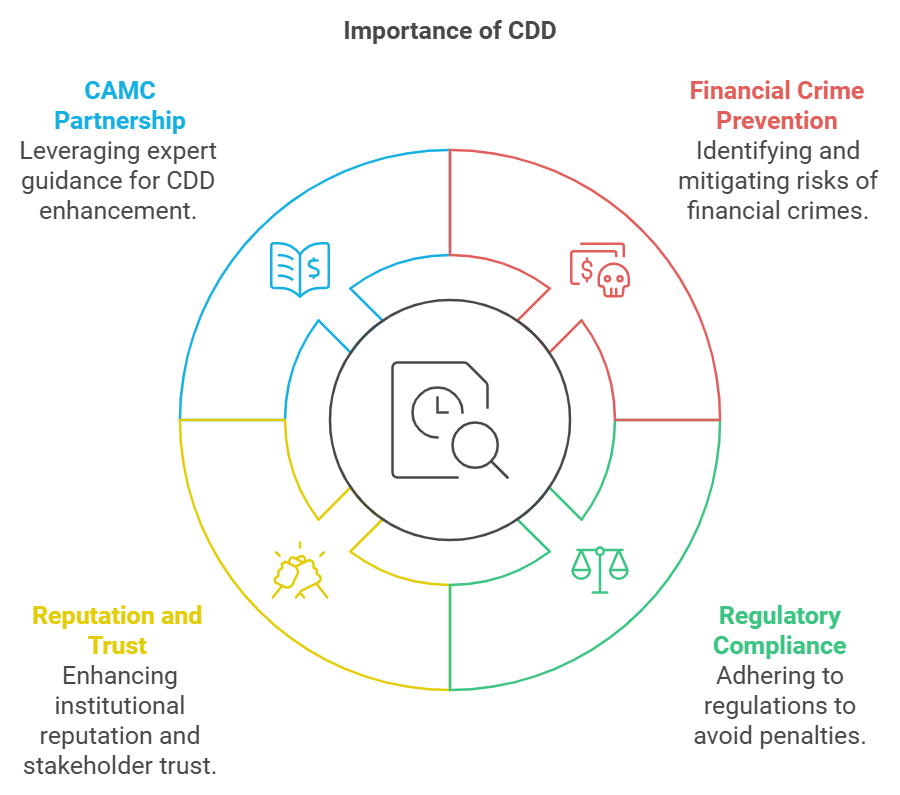

Importance of CDD:

– Prevention of Financial Crimes: CDD is essential in identifying and mitigating the risks associated with money laundering, terrorist financing, and proliferation financing.

– Regulatory Compliance: Adhering to CDD regulations is crucial to avoid legal penalties and maintain the integrity of the financial system.

– Reputation and Trust: Effective CDD measures enhance the reputation of financial institutions and businesses, fostering trust among stakeholders.

CAMC’s Role: By partnering with CAMC, institutions can leverage expert guidance and advanced solutions to enhance their CDD processes, ensuring compliance and cultivating a trustworthy reputation.

Customer Due Diligence is a pivotal element in the UAE’s strategy to combat financial crimes. By understanding and implementing effective CDD practices, institutions can not only comply with stringent regulations but also protect themselves against significant financial and reputational risks. CAMC stands ready to support organizations in achieving these goals through expert consultation, innovative solutions, and robust training programs.

To learn more about how CAMC can assist you in enhancing your CDD framework, reach out to us today. We offer tailored solutions and expert advice to help you stay ahead in the ever-changing landscape of AML compliance.