Introduction

The Know Your Customer (KYC) landscape in the United Arab Emirates (UAE) is constantly evolving to align with international standards for Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF). Recent updates to KYC regulations reflect the country’s commitment to combating financial crime and ensuring transparency across all financial transactions. This guide will provide an overview of the latest KYC updates in the UAE and highlight what businesses need to know to stay compliant.

Why Are KYC Updates Important?

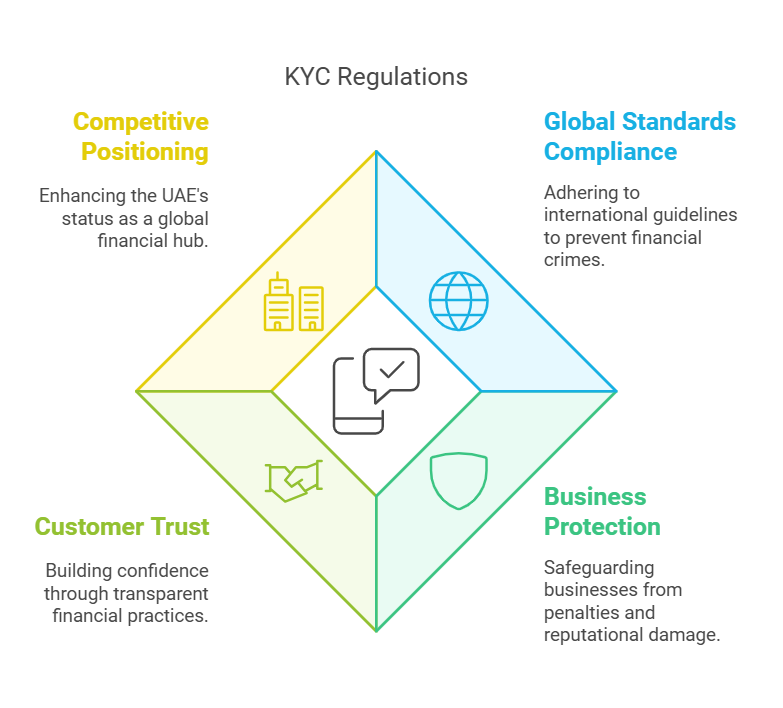

KYC regulations are the foundation of the financial industry’s efforts to combat money laundering and financial terrorism. The latest updates ensure that businesses adhere to global standards set by international bodies such as the Financial Action Task Force (FATF) and the United Nations Office on Drugs and Crime (UNODC). Compliance with these updates is essential for businesses to avoid penalties, protect their reputation, and contribute to a safer financial ecosystem.

The updated KYC measures are also designed to foster greater trust between financial institutions and their clients. By ensuring that financial entities operate in a transparent manner, customers can be assured that their transactions are conducted within a compliant, secure framework. Additionally, the UAE aims to remain competitive as a global financial hub, and strong KYC regulations play a key role in achieving this goal.

Key Changes in KYC Regulations in the UAE

1. Enhanced Due Diligence (EDD) Requirements

Recent updates place greater emphasis on Enhanced Due Diligence (EDD) for high-risk customers. The UAE Central Bank has mandated that businesses must conduct more rigorous background checks for customers who are deemed high-risk due to factors such as their nationality, occupation, or source of wealth.

EDD Measures Include:

- Verifying the source of funds and wealth.

- Conducting in-depth background checks on politically exposed persons (PEPs).

- Monitoring ongoing transactions for suspicious activity.

- Gathering additional information on the purpose of transactions and the intended nature of the business relationship.

These requirements aim to strengthen the financial system by ensuring that businesses can effectively identify and mitigate risks. EDD plays a crucial role in preventing financial crimes and safeguarding the integrity of the financial system. For more information on EDD, visit our Customer Due Diligence Services.

2. Digital KYC Verification

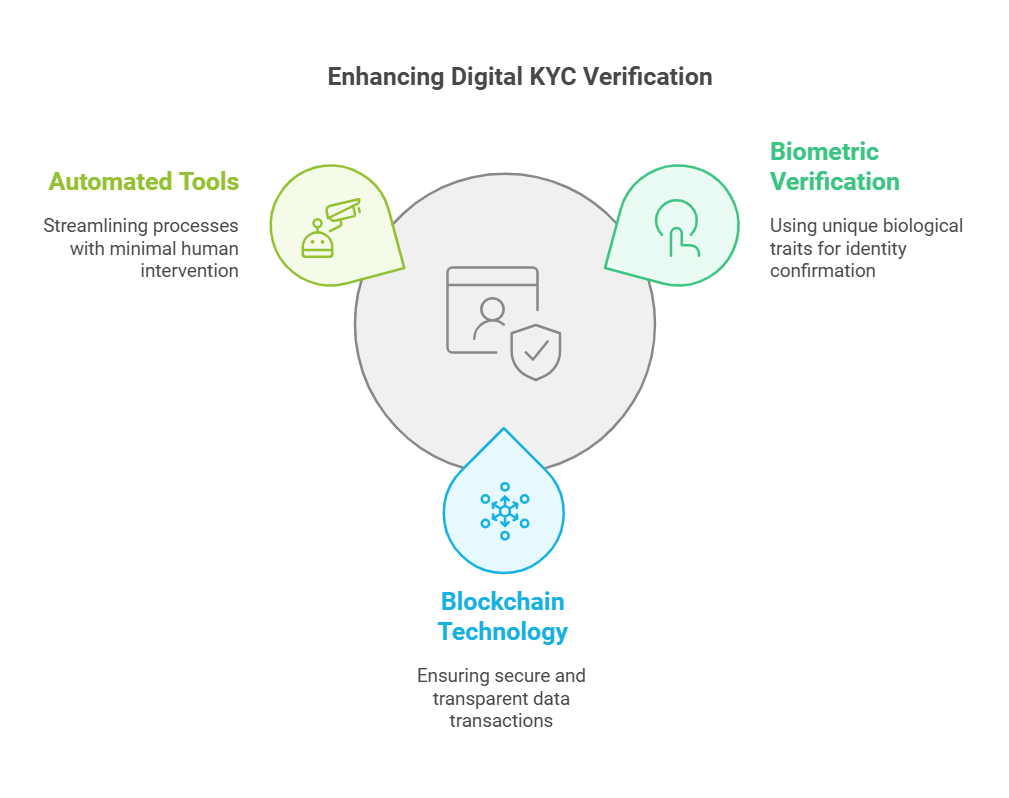

The UAE Central Bank and other regulatory authorities are promoting the use of digital KYC to enhance efficiency and accuracy. Businesses are encouraged to adopt e-KYC solutions that leverage advanced technologies like biometric verification and blockchain to verify customer identities in real time.

Benefits of Digital KYC:

- Reduces manual errors.

- Speeds up the customer onboarding process.

- Enhances data accuracy and security.

- Provides a more seamless customer experience by minimizing paperwork.

Digital KYC also allows for faster updates to customer information, enabling businesses to maintain more accurate and up-to-date records. With automated tools, financial institutions can quickly adapt to changes in a customer’s risk profile. For assistance in setting up digital KYC systems, visit our Compliance Department Setup Services.

3. Increased Focus on Politically Exposed Persons (PEPs)

New regulations require businesses to implement enhanced measures for identifying and monitoring politically exposed persons (PEPs). These individuals, due to their public roles, pose a higher risk for money laundering and corruption.

PEP Requirements Include:

- Implementing ongoing monitoring for transactions involving PEPs.

- Conducting in-depth due diligence to verify the source of wealth.

- Using automated screening tools to identify PEPs during onboarding.

- Conducting regular reviews of existing PEP customers to identify changes in risk levels.

The updated requirements also emphasize the need for proactive measures in detecting potential PEP relationships. Businesses must use data-driven approaches and implement continuous monitoring tools to ensure they remain compliant. Learn more about how to handle PEP verification through our PEP Verification Services.

4. Ongoing Customer Monitoring

KYC regulations now emphasize the importance of ongoing customer monitoring. It is not enough to verify a customer’s identity at the time of onboarding; businesses must also track transactions to identify any changes in risk level.

Ongoing Monitoring Measures:

- Regularly updating customer profiles.

- Using automated systems to flag unusual transactions.

- Ensuring all suspicious activities are reported promptly.

- Periodically reassessing the risk profile of customers, particularly those involved in high-risk industries or jurisdictions.

Automated transaction monitoring tools are increasingly being adopted by businesses to identify and respond to suspicious activities in real time. With these tools, compliance teams can be alerted to red flags such as unusual transaction sizes, unexpected geographic locations, or changes in customer behavior. For more details on how to maintain compliance with ongoing monitoring, check our AML/CFT Regulatory Reporting Services.

5. Updated Record Keeping Requirements

The latest KYC updates extend the duration for which businesses must keep customer records. Businesses are now required to maintain detailed records for at least seven years after the end of the business relationship.

Records to Maintain:

- Customer identification information.

- Transaction histories.

- Documentation of all due diligence conducted.

- Evidence of compliance with KYC and AML measures, including internal communication and decision-making processes.

Proper record keeping is vital for compliance audits and investigations. Accurate records not only demonstrate compliance to regulatory authorities but also help businesses review past decisions and transactions in case of legal disputes. For guidance on maintaining compliant records, explore our Compliance Department Setup Services.

How to Stay Compliant with the Latest KYC Updates

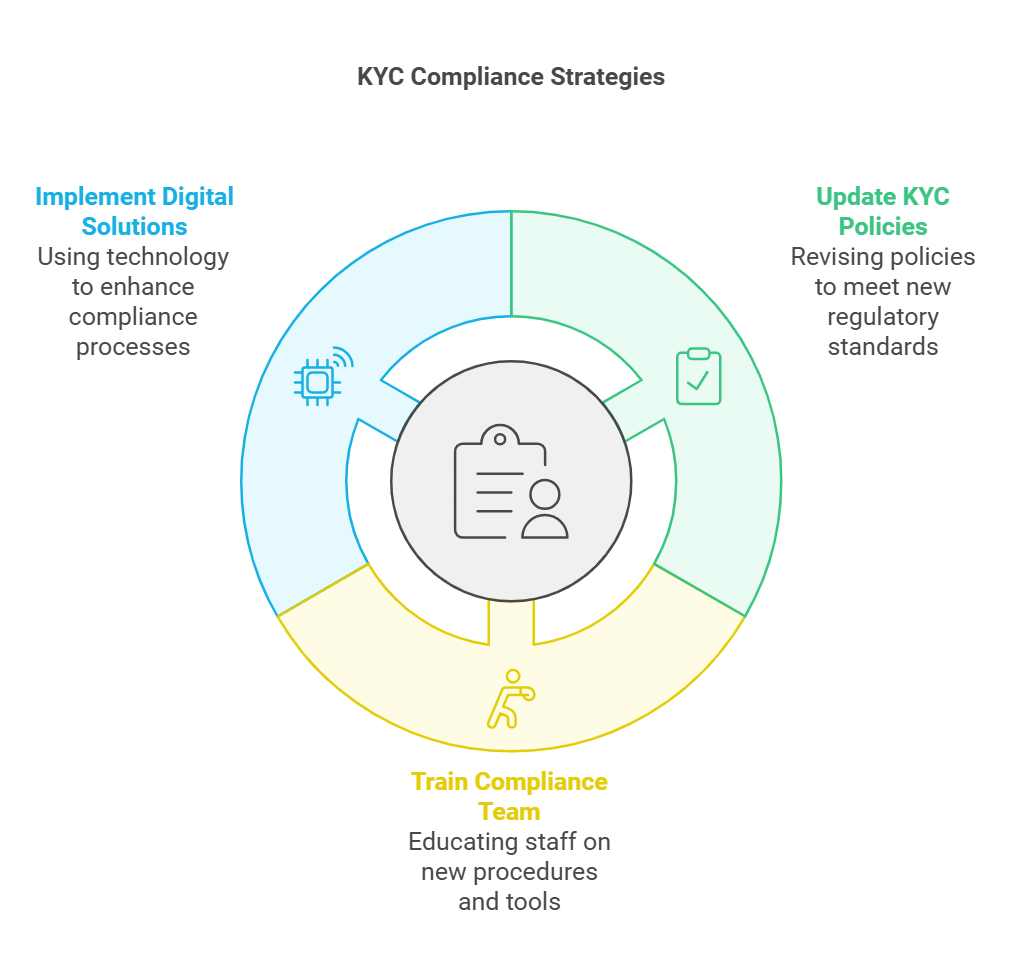

1. Update Your KYC Policies

Businesses must update their KYC policies to incorporate the latest regulatory changes. This includes defining clear procedures for identifying high-risk customers, conducting ongoing monitoring, and maintaining accurate records.

Steps to Update KYC Policies:

- Review existing KYC policies to identify gaps.

- Incorporate new EDD and record-keeping requirements.

- Train employees on the updated procedures.

- Use compliance management software to streamline policy updates and ensure all employees have access to the latest versions.

Having a well-documented policy helps demonstrate to regulatory authorities that your business is committed to complying with KYC requirements. Visit our AML Policy Development Services for assistance in updating your KYC policies.

2. Train Your Compliance Team

The recent updates require businesses to invest in employee training to ensure that staff members are well-versed in the new KYC procedures. Training programs should cover areas such as digital verification, EDD, and PEP identification.

Key Training Areas:

- How to conduct enhanced due diligence for high-risk customers.

- Using digital tools for customer verification.

- Understanding the new record-keeping requirements.

- Recognizing red flags for suspicious activity and escalating concerns effectively.

Regular training ensures that your compliance team remains knowledgeable about the latest updates and can implement them effectively. For comprehensive training, explore our AML/CFT Compliance Training Services.

3. Implement Digital Solutions

Digital solutions are becoming an integral part of KYC compliance. Businesses should consider integrating e-KYC platforms to streamline customer verification, reduce manual errors, and improve data accuracy.

Recommended Digital Solutions:

- Biometric Verification: To authenticate customer identities during onboarding.

- Automated Transaction Monitoring: To flag unusual activities in real time.

- Blockchain: To enhance transparency and data integrity.

- Artificial Intelligence (AI): AI-driven tools can help assess customer risk profiles, analyze transaction patterns, and detect potential fraudulent activity.

By leveraging digital tools, businesses can save time, reduce costs, and maintain compliance more effectively. Consider using automated tools as part of our Compliance Department Setup Services.

Challenges in Implementing the Latest KYC Updates

1. Adapting to Digital Verification

While digital verification offers numerous benefits, businesses may face challenges in adopting new technologies. Some of these challenges include the cost of implementing e-KYC systems and the need to train employees on how to use these technologies effectively.

Overcoming Challenges:

- Cost Management: Consider cloud-based e-KYC solutions to minimize upfront investment.

- Training: Provide continuous training to employees to ensure they can navigate and utilize the digital systems effectively.

- Vendor Partnerships: Collaborate with specialized technology vendors to tailor digital KYC solutions that suit your business needs.

2. Increased Compliance Costs

With stricter requirements for EDD and record keeping, the cost of compliance has increased. Businesses, especially small and medium enterprises (SMEs), may find it challenging to allocate resources for the additional compliance measures.

Cost-Effective Solutions:

- Outsource compliance functions to specialized AML consultancies.

- Use cloud-based solutions for digital KYC to reduce upfront costs.

- Prioritize high-risk areas to allocate compliance resources effectively.

How CAMC Can Assist

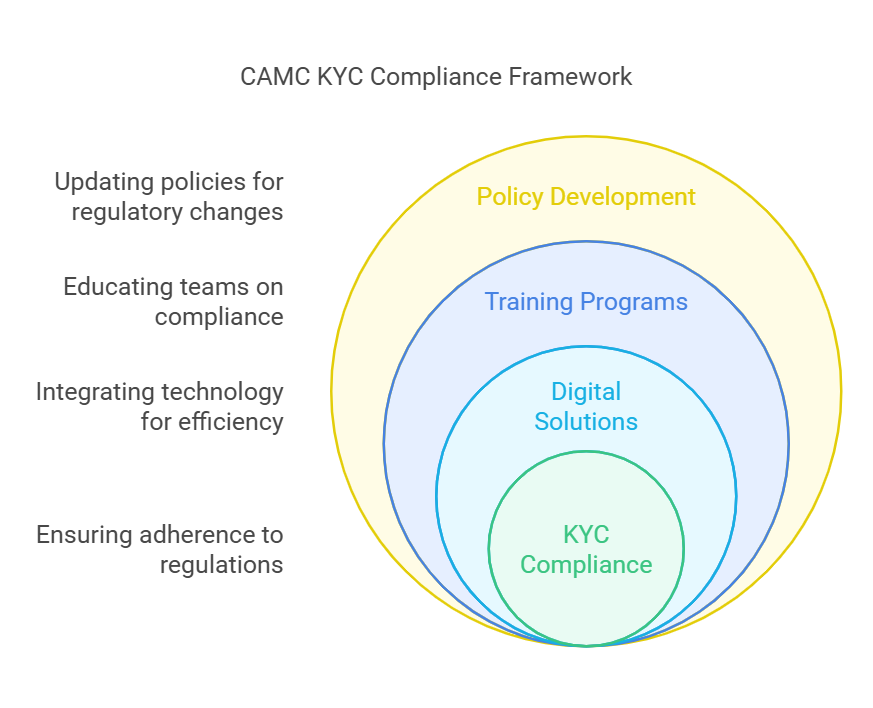

Chartered AML Consultants (CAMC) is committed to helping businesses in the UAE navigate the complexities of the latest KYC updates. Our services are designed to ensure that your business remains compliant while minimizing operational disruptions.

1. Policy Development and Updates

We assist businesses in developing and updating their KYC policies to comply with the latest regulations. Our team will help you identify gaps, incorporate new requirements, and create a robust compliance framework.

For more information, visit our AML Policy Services.

2. Compliance Training Programs

Our AML compliance training programs are tailored to educate your compliance team on the latest KYC requirements. We ensure that your staff is equipped with the skills needed to conduct enhanced due diligence, identify PEPs, and implement ongoing monitoring.

Our training programs include hands-on workshops, real-world case studies, and ongoing assessments to ensure that your team is fully prepared to handle compliance challenges. Explore our Training Programs for more details.

3. Digital Compliance Solutions

We offer guidance on integrating digital compliance solutions to streamline your KYC processes. From biometric verification to automated transaction monitoring, our experts will help you choose the right tools for your business.

We also provide support in implementing AI-based tools that can help with customer risk assessments and transaction analysis, ensuring your compliance processes are both efficient and effective. Learn more about our Compliance Department Setup Services.

Conclusion

The latest KYC updates in the UAE are part of the country’s efforts to align with international standards for AML and CTF. By staying informed and adapting to these changes, businesses can protect themselves from financial crime risks and ensure compliance with regulatory requirements.

Compliance with updated KYC regulations involves implementing enhanced due diligence, adopting digital verification methods, and conducting ongoing customer monitoring. Businesses must take a proactive approach, ensuring that policies are updated, employees are trained, and the latest technologies are integrated into compliance practices.

CAMC is here to assist businesses in implementing the latest KYC measures effectively. From policy development to digital solutions and employee training, we provide comprehensive support to help your business stay compliant. Partnering with CAMC means you can focus on your core operations while we handle the complexities of KYC and AML compliance.

References

Financial Conduct Authority (FCA) – AML Guidance

https://www.fca.org.uk/firms/financial-crime/aml

United Nations Office on Drugs and Crime – Anti-Money Laundering

https://www.unodc.org/unodc/en/money-laundering/index.html

OECD – Politically Exposed Persons (PEPs) in AML

https://www.oecd.org/corruption/anti-bribery/PEPs-in-AML

Basel Institute on Governance – AML Index

https://baselgovernance.org/basel-aml-index