Introduction

In today’s globalized economy, combating money laundering and terrorism financing has emerged as a critical priority, particularly in the United Arab Emirates (UAE). The UAE has been at the forefront of implementing robust Anti-Money Laundering (AML) frameworks, adapting to evolving threats and international standards. If you’re a business operating in this region, understanding the nuances of AML compliance and the intricacies of the goAML registration process is not just beneficial—it’s imperative. This guide aims to demystify these complex regulations, offering a clear path to compliance while highlighting the pivotal role CAMC (Compliance and Anti-Money Laundering Consultancy) plays in facilitating this process.

Understanding UAE’s AML Framework

The Legal Landscape

The UAE’s AML legal framework is anchored by Federal Decree No. 20 of 2018, among other pivotal regulations. Recent amendments and the introduction of the National Strategy for AML/CFT/CPF for 2024-2027 underscore a heightened commitment to mitigating financial crimes. This strategy outlines 11 strategic goals, emphasizing risk-based compliance, global collaboration, and proactive detection of illicit activities.

Who Needs to Comply?

Entities that fall within both financial and non-financial sectors, including Designated Non-Financial Businesses and Professions (DNFBPs), are mandated to comply with UAE’s AML laws. Compliance officers and professionals within these organizations are crucial in navigating these legal requirements.

Key Steps for goAML Registration

Navigating the goAML registration involves several critical steps. Here’s a comprehensive guide to ensure your business remains compliant:

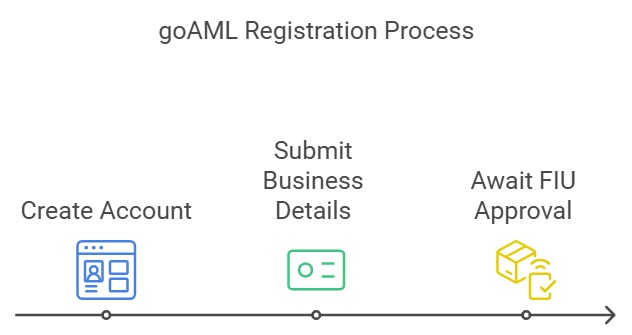

- Registration with the goAML Portal

All relevant entities must register on the goAML platform. This essential step ensures your business is recognized by regulatory bodies and is a prerequisite for fulfilling AML obligations. Registration involves:

- Creating an account on the platform.

- Providing accurate business details and required documentation.

- Awaiting approval from the Financial Intelligence Unit (FIU).

Tip: Ensure all submitted information is current and accurate to avoid delays.

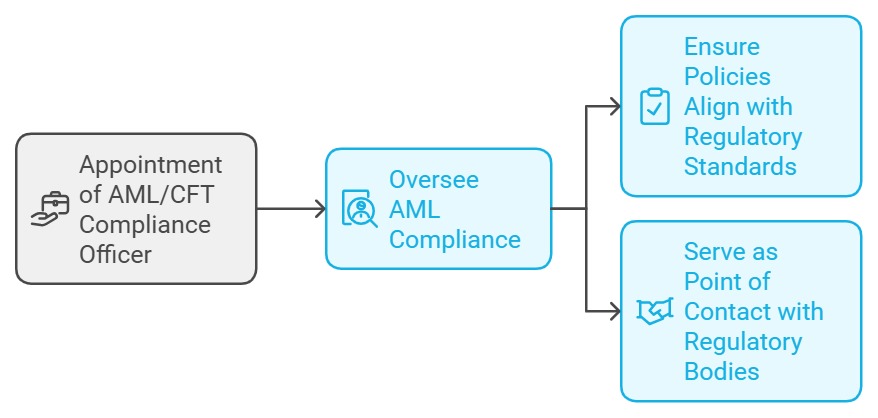

- Appointment of a Compliance Officer

Appointing a competent AML/CFT Compliance Officer is mandatory. This individual will oversee AML compliance, ensuring all policies and procedures align with regulatory standards. They will also serve as the point of contact with regulatory bodies.

Tip: Choose a professional with a strong background in compliance and risk management.

- Risk Assessment and Due Diligence

Conducting a thorough risk assessment is critical to identifying and mitigating exposure to money laundering and terrorism financing risks. Implementing effective Customer Due Diligence (CDD) processes ensures that your business can:

- Identify and verify the identity of customers.

- Assess potential risks associated with customer relationships.

Example: Consider scenarios where high-risk customers are involved and tailor your due diligence processes accordingly.

- Developing Internal Policies and Procedures

Your business must develop and implement robust AML policies and procedures, aligned with the Enterprise Wide Risk Assessment (EWRA). These should include:

- Clear guidelines for identifying suspicious activities.

- Protocols for reporting and record-keeping.

Tip: Regularly update policies to reflect changes in regulatory requirements and business operations.

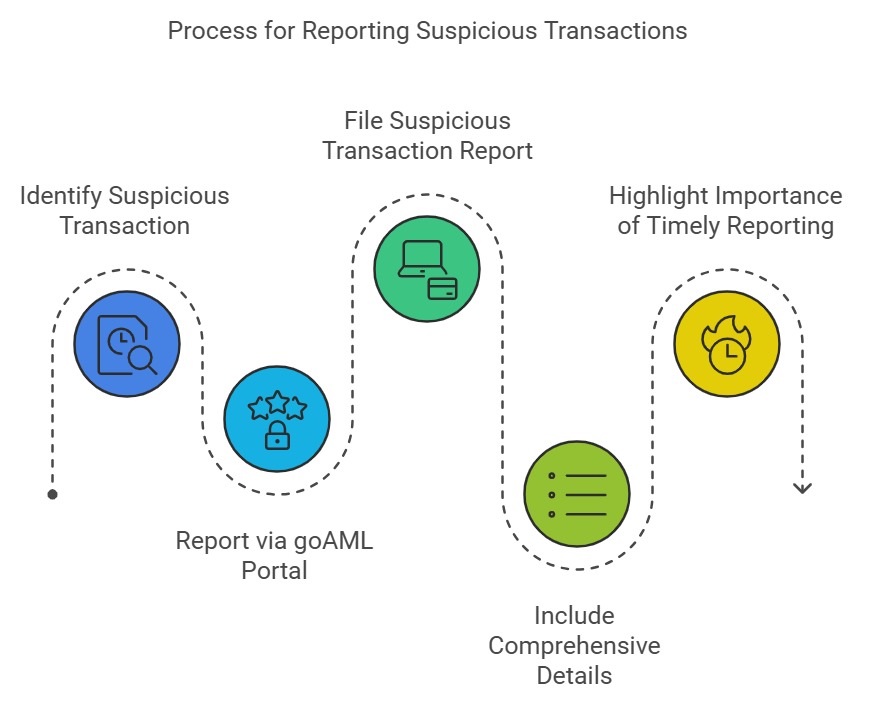

- Reporting Suspicious Transactions

Ensure you have an established process for identifying and reporting suspicious transactions through the goAML Portal. This includes filing Suspicious Transaction Reports (STRs) promptly, with comprehensive details about the activity in question.

Data Insight: Recent enforcement action examples demonstrate the importance of timely and accurate reporting.

- Regular Training and Record Keeping

Conduct regular training sessions for staff on AML/CFT matters to maintain awareness and compliance. Moreover, maintain records for at least five years to ensure preparedness for audits and examinations by authorities.

Example: Use case studies of enforcement actions to highlight the importance of compliance.

Recent Reforms and Strategies

In response to evolving risks, the UAE has enhanced its AML framework through several reforms:

National Strategy for AML/CFT/CPF 2024-2027

The new strategy aims to bolster the UAE’s defenses against financial crimes, with strategic goals focusing on enhancing risk-based compliance and international cooperation.

Enhanced Supervision and Enforcement

The Central Bank of UAE (CBUAE) has strengthened its supervisory capabilities, leading to significant fines and license revocations for non-compliance. For instance, a local bank was penalized USD 1.6 million for AML/CFT lapses.

CAMC: Guiding You Through Compliance

CAMC plays an instrumental role in helping businesses navigate the complexities of AML compliance in the UAE. With expertise in local and international regulations, CAMC offers:

- Tailored compliance programs.

- Comprehensive risk assessments.

- Specialized training for compliance officers.

- Support in goAML registration and reporting.

How CAMC Helps: By partnering with CAMC, businesses gain access to cutting-edge strategies and tools designed to enhance compliance and mitigate risks effectively.

Navigating AML compliance and the goAML registration in the UAE is a daunting yet essential task for businesses aiming to maintain integrity and avoid hefty penalties. By understanding the legal framework, appointing competent compliance personnel, and leveraging the expertise of consultants like CAMC, businesses can ensure seamless compliance with the UAE’s stringent AML laws.

Have questions on goAML registration or AML compliance? Contact us today to find out how CAMC can streamline your compliance journey.