Introduction

In today’s regulatory environment, compliance with Know Your Customer (KYC) requirements is not just a legal obligation but also a critical aspect of maintaining trust and transparency in business. The United Arab Emirates (UAE) has stringent KYC regulations in place to prevent money laundering, terrorist financing, and other financial crimes. For businesses operating in the UAE, it is crucial to understand which documents are needed to comply with KYC requirements to avoid legal and reputational risks.

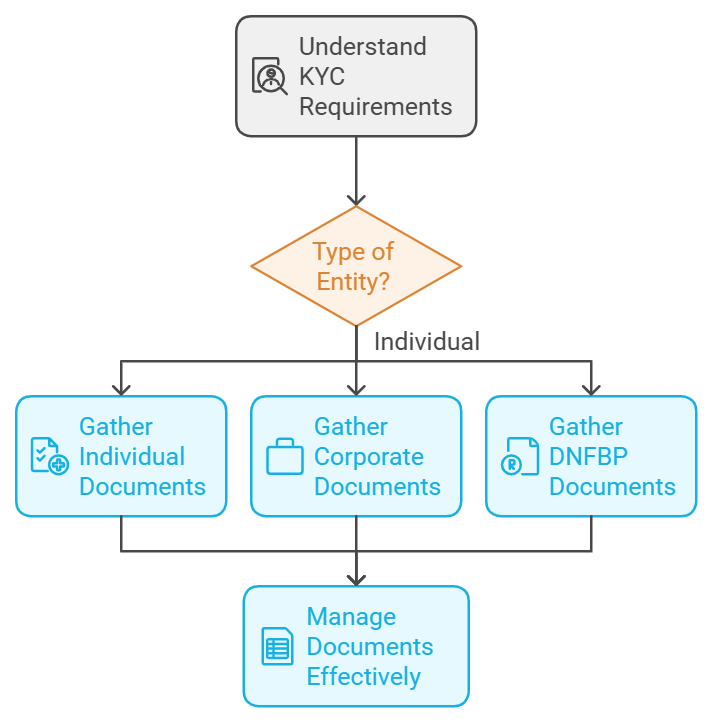

This comprehensive guide will provide a detailed checklist of KYC documents required for different types of entities and individuals in the UAE, along with best practices for managing these documents effectively.

What is KYC and Why is it Important?

KYC (Know Your Customer) is a set of guidelines and processes used by financial institutions and businesses to verify the identity of their clients and assess the risks associated with a business relationship. The goal of KYC is to ensure that entities are not facilitating money laundering, terrorist financing, or other illegal activities.

In the UAE, KYC regulations are governed by the Central Bank of the UAE and align with international standards, including those set by the Financial Action Task Force (FATF). The implementation of KYC processes helps businesses maintain a high level of transparency, reduce financial risks, and comply with regulatory requirements. To learn more about KYC regulations in the UAE, visit our KYC and Due Diligence Services.

Key Components of KYC in the UAE

1. Customer Identification

The first step in the KYC process is Customer Identification. Businesses must collect and verify identity documents to ensure that their clients are who they claim to be. This involves gathering personal identification information, conducting due diligence, and cross-referencing the information with reliable databases.

2. Customer Due Diligence (CDD)

Customer Due Diligence (CDD) involves assessing the potential risks associated with each customer based on the nature of their business, geographic location, and other risk factors. For high-risk clients, businesses must conduct Enhanced Due Diligence (EDD), which involves collecting additional information and closely monitoring the customer’s activities.

3. Ongoing Monitoring

KYC is not a one-time process; it involves ongoing monitoring of customer transactions and updating records to ensure compliance. Ongoing monitoring helps businesses detect suspicious activities and respond appropriately.

KYC Documents Checklist for UAE Businesses

The KYC documents required for UAE businesses may vary depending on the type of entity and the risk profile of the customer. Below is a comprehensive checklist of KYC documents needed for different types of clients:

1. Individual Customers

For individual clients, businesses need to collect the following documents:

- Passport Copy: A valid passport copy of the individual, including the signature page.

- Emirates ID: A copy of the individual’s Emirates ID, which serves as a national identification card.

- Proof of Address: Recent utility bills, bank statements, or tenancy contracts that confirm the individual’s address.

- Source of Funds: Documentation that explains the source of the individual’s funds, such as bank statements, salary certificates, or tax returns.

- Photograph: A recent passport-sized photograph of the individual.

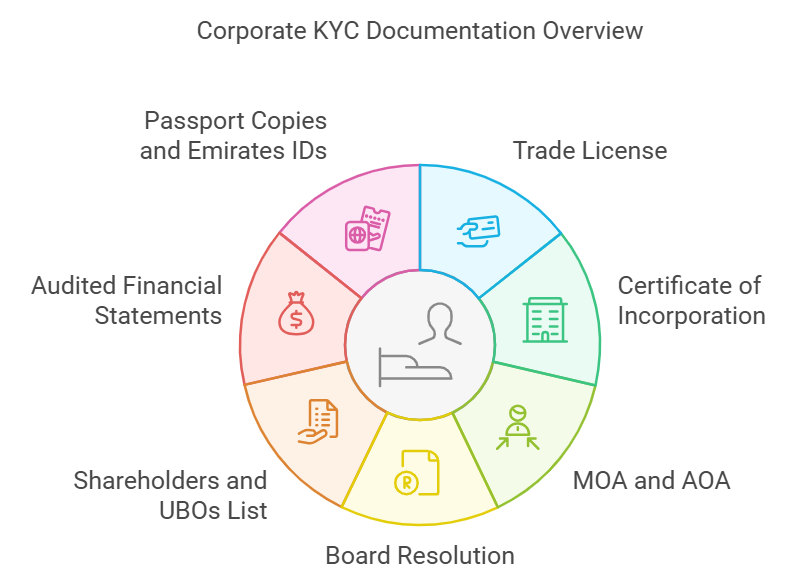

2. Corporate Clients

For corporate clients, the KYC process is more extensive, and businesses are required to collect the following documents:

- Trade License: A valid trade license issued by the relevant authorities in the UAE.

- Certificate of Incorporation: This document proves the company is registered and legally recognized.

- Memorandum of Association (MOA) and Articles of Association (AOA): These documents provide details about the company’s structure, ownership, and operational guidelines.

- Board Resolution: A board resolution authorizing a specific individual to act on behalf of the company for the purpose of opening accounts or conducting transactions.

- List of Shareholders and Ultimate Beneficial Owners (UBOs): Information about the shareholders and UBOs, including their identification documents.

- Audited Financial Statements: Recent audited financial statements that provide insights into the company’s financial health.

- Passport Copies and Emirates IDs of Authorized Signatories: Identification documents for all authorized signatories representing the company.

3. Designated Non-Financial Businesses and Professions (DNFBPs)

DNFBPs include entities like real estate brokers, precious metal dealers, and law firms. These entities are required to comply with specific KYC requirements, including:

- Trade License: A copy of the trade license specific to the profession.

- Identification Documents: Passport copies, Emirates IDs, and proof of address for the firm’s partners or owners.

- Proof of Business Activities: Documentation that provides a clear picture of the firm’s business activities and clientele.

- Risk Assessment Reports: A report that assesses the firm’s risk exposure to money laundering and terrorist financing.

4. Trusts and Foundations

For trusts and foundations, the KYC process requires the following documents:

- Trust Deed or Foundation Charter: The legal document establishing the trust or foundation.

- Details of Trustees, Settlors, and Beneficiaries: Identification documents for trustees, settlors, and beneficiaries involved in the trust or foundation.

- Source of Funds: Documentation indicating the source of funds and assets held by the trust or foundation.

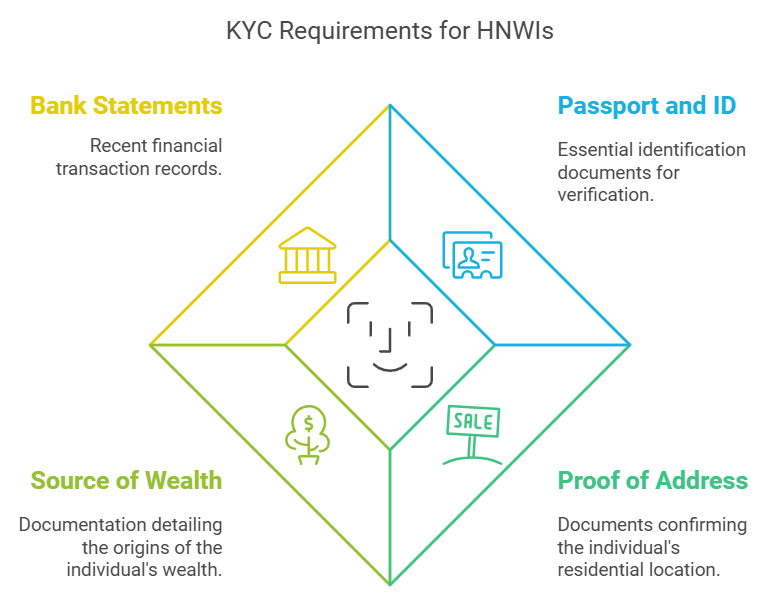

5. High-Net-Worth Individuals (HNWIs)

For High-Net-Worth Individuals (HNWIs), the following KYC documents are required:

- Passport and Emirates ID Copies: Identification documents for the individual.

- Proof of Address: Recent utility bills or tenancy contracts to verify the individual’s residential address.

- Source of Wealth: Detailed documentation explaining the source of the individual’s wealth, such as investment portfolios, property deeds, or inheritance documents.

- Bank Statements: Recent bank statements showing the individual’s financial transactions.

Enhanced Due Diligence (EDD) Requirements

For clients that present a higher risk, such as Politically Exposed Persons (PEPs) or clients from high-risk jurisdictions, Enhanced Due Diligence (EDD) is required. EDD involves collecting additional documents and closely scrutinizing the customer’s activities to ensure they do not pose a risk to the business.

EDD Documents Checklist

- Source of Wealth: Detailed information about the client’s source of wealth and the origin of their funds.

- Additional Identification Documents: Multiple identification documents to verify the customer’s identity.

- Background Checks: Conducting background checks using publicly available information, sanctions lists, and databases.

- Ongoing Monitoring Plan: A detailed plan for ongoing monitoring of the client’s activities and transactions.

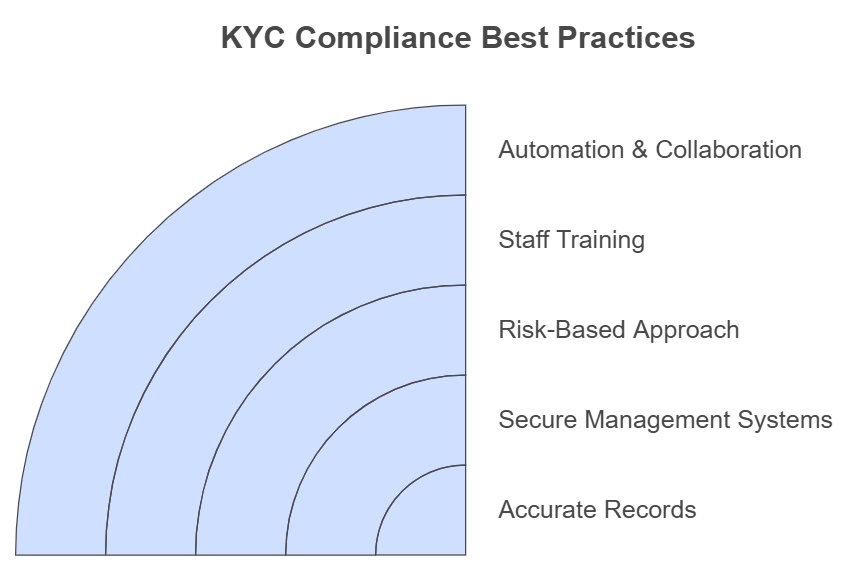

Best Practices for Managing KYC Documents

1. Maintain Accurate and Up-to-Date Records

One of the key aspects of effective KYC compliance is maintaining accurate and up-to-date records. Businesses should periodically review their KYC documents to ensure that the information is current and reflects any changes in the customer’s profile.

2. Use Secure Document Management Systems

KYC documents contain sensitive information, and businesses must use secure document management systems to store and manage these records. Implementing encryption, access controls, and data backups can help protect customer information from unauthorized access and breaches.

3. Implement a Risk-Based Approach

Not all customers present the same level of risk. Businesses should implement a risk-based approach to KYC compliance, where customers are categorized based on their risk profiles. This approach allows businesses to allocate resources efficiently and focus on high-risk customers who require additional scrutiny.

Learn more about how to implement a risk-based approach with our Risk Assessment Services.

4. Conduct Regular Training for Staff

Employees responsible for collecting and verifying KYC documents must be well-trained to identify potential red flags and ensure compliance. Regular training sessions help employees stay informed about the latest regulatory changes and best practices in KYC compliance.

Explore our AML Compliance Training Services for tailored training programs.

5. Automate KYC Processes

Automation can significantly improve the efficiency and accuracy of KYC processes. By using technology to automate document collection, verification, and risk assessments, businesses can reduce human error and streamline their compliance efforts.

6. Collaborate with Compliance Experts

KYC compliance can be complex, especially for businesses dealing with high-risk clients or large volumes of transactions. Collaborating with compliance experts like CAMC can help businesses navigate the complexities of KYC requirements and ensure full compliance.

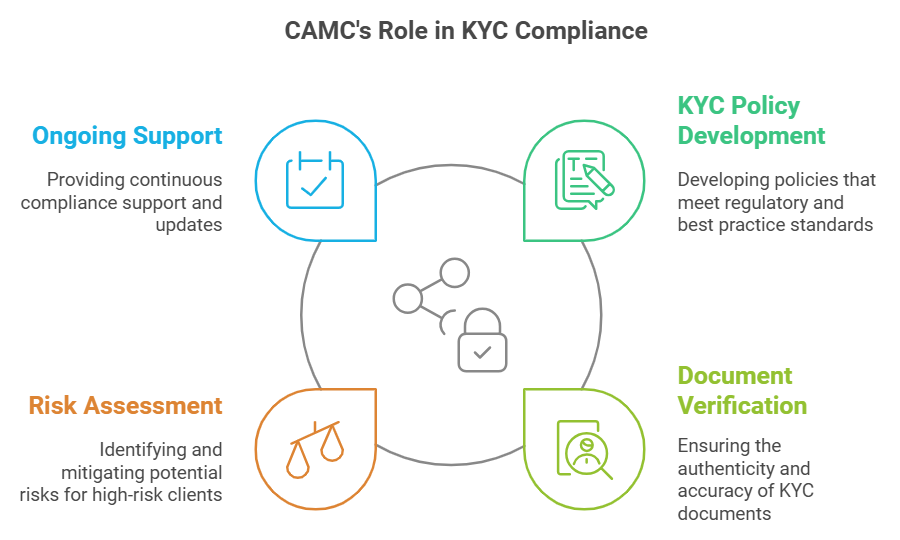

How CAMC Can Assist with KYC Compliance

Chartered AML Consultants (CAMC) provides comprehensive solutions to help businesses comply with KYC regulations in the UAE. Our services include:

1. KYC Policy Development

We assist businesses in developing KYC policies that align with regulatory requirements and international best practices. Our policies cover all aspects of customer identification, due diligence, and ongoing monitoring.

2. KYC Document Verification

Our team of experts helps businesses verify the authenticity of KYC documents, ensuring that all customer information is accurate and reliable. We use advanced verification tools and techniques to detect fraudulent documents and mitigate risks.

3. Risk Assessment and Enhanced Due Diligence

We offer risk assessment and enhanced due diligence services for high-risk clients, helping businesses identify potential risks and implement measures to mitigate them. Our EDD services include background checks, source of wealth verification, and ongoing monitoring.

4. Ongoing Compliance Support

Our ongoing compliance support services help businesses stay updated with regulatory changes and maintain compliance. We provide regular audits, updates on regulatory requirements, and assistance with managing KYC documents.

Conclusion

Complying with KYC requirements is essential for businesses operating in the UAE to prevent financial crimes and maintain transparency. By understanding the specific KYC documents required for different types of clients and implementing best practices for managing these documents, businesses can ensure compliance and reduce their risk exposure.

Whether you are dealing with individual customers, corporate clients, or high-net-worth individuals, having a comprehensive KYC process in place is crucial for mitigating risks and maintaining the trust of regulators, clients, and partners. CAMC offers tailored solutions to assist businesses in meeting their KYC obligations effectively and efficiently.

For more information on how CAMC can help your business with KYC compliance, contact us today.

References

United Nations Office on Drugs and Crime (UNODC) – goAML Platform

https://www.unodc.org/goaml

Financial Action Task Force (FATF) Recommendations

https://www.fatf-gafi.org/recommendations.html

UAE Central Bank – AML/CFT Guidelines

https://www.centralbank.ae/en/anti-money-laundering-and-counter-terrorist-financing