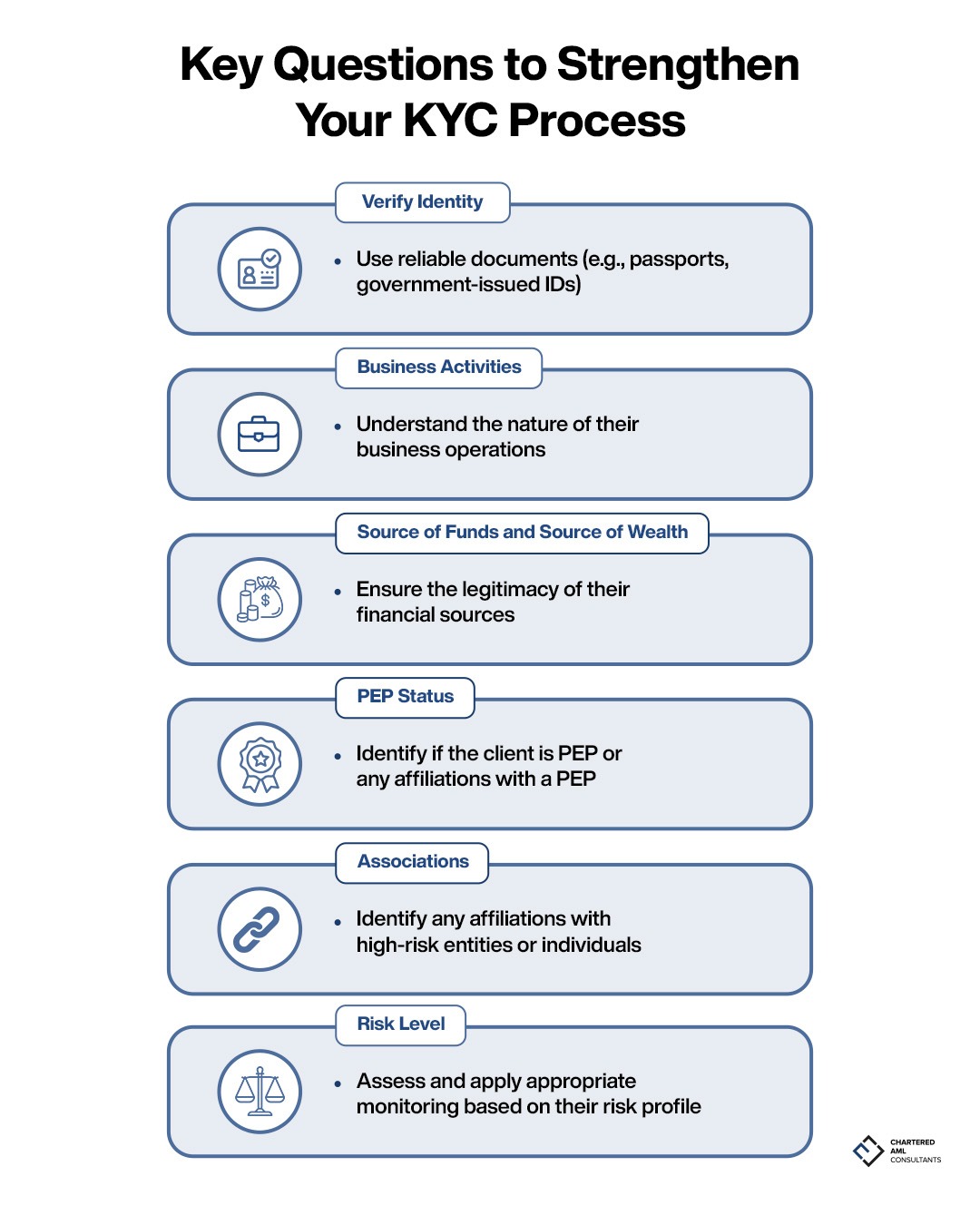

Effective Know Your Customer (KYC) processes are essential for maintaining compliance and protecting your business from financial crimes. By implementing a robust KYC process, you can ensure that your business adheres to regulatory requirements and mitigates risks associated with financial transactions. Here are some key questions to consider when strengthening your KYC process:

Verify Identity

Ensuring that you are using reliable documents (e.g., passports, government-issued IDs) to verify the identity of your customers is a fundamental step in the KYC process. This verification process helps in preventing identity theft and fraud, ensuring that you are dealing with legitimate individuals or entities. It also aids in maintaining the integrity of your customer database, which is critical for accurate record-keeping and reporting.

Additionally, consider integrating advanced verification technologies such as biometric authentication and digital identity verification to enhance the accuracy and efficiency of the identity verification process. These technologies can provide an extra layer of security, making it more difficult for fraudsters to bypass the system.

Business Activities

Understanding the nature of your customer’s business operations is crucial for assessing the level of risk associated with the customer. This involves gaining insights into the customer’s industry, business model, and typical transaction patterns. By doing so, you can identify any unusual or suspicious activities that may indicate potential money laundering or other financial crimes.

Furthermore, this understanding helps in tailoring your due diligence efforts to the specific risks associated with different industries. For example, businesses in high-risk sectors such as real estate or precious metals may require more stringent monitoring compared to those in lower-risk industries.

Source of Funds and Source of Wealth

Ensuring the legitimacy of your customer’s financial sources is a critical component of the KYC process. This involves verifying the origin of the funds and wealth to ensure that they are not derived from illicit activities. Understanding the source of funds and wealth helps in detecting and preventing money laundering activities, as well as ensuring that your business is not inadvertently facilitating financial crimes.

Implementing thorough checks and balances, such as requiring detailed financial statements and transaction histories, can help in verifying the legitimacy of the funds. Additionally, utilizing advanced analytics and machine learning tools can assist in identifying any anomalies or red flags in the financial data.

PEP Status

Identifying if the client is a Politically Exposed Person (PEP) or has any affiliations with a PEP is essential for risk management. PEPs are individuals who hold prominent public positions or have close associations with such individuals, and they pose a higher risk due to their potential involvement in bribery, corruption, and other financial crimes.

To effectively manage the risks associated with PEPs, consider implementing enhanced due diligence measures, such as conducting detailed background checks and continuous monitoring of their transactions. This will help in identifying any suspicious activities early on and taking appropriate actions to mitigate the risks.

Associations

Identifying any affiliations with high-risk entities or individuals is critical for understanding the network and potential risks associated with your customer. This involves examining the customer’s business relationships, including suppliers, partners, and other associated entities, to identify any connections to known criminals or high-risk individuals.

By leveraging advanced analytics and data mining techniques, you can uncover hidden associations and connections that may not be immediately apparent. This will enable you to take proactive measures to mitigate the risks and ensure that your business remains compliant with regulatory requirements.

Risk Level

Assessing and applying appropriate monitoring based on the customer’s risk profile is a dynamic and ongoing process. Regularly updating risk assessments ensures that your business stays compliant with regulatory requirements and can proactively address any emerging risks. This involves continuously evaluating the customer’s risk level based on various factors such as transaction patterns, industry trends, and regulatory changes.

Implementing a risk-based approach to monitoring allows you to allocate resources more effectively and focus on high-risk areas that require more attention. Additionally, leveraging automated monitoring tools and real-time analytics can help in detecting any suspicious activities promptly and taking swift actions to address them.

For more information on enhancing your KYC process in the UAE, check out our services page and industries page.

Stay Connected

Follow us on social media for more insights and updates: