In the United Arab Emirates, Chartered AML Consultants has established itself as a reliable provider of KYC, EDD, and CDD services. Our experienced staff has considerable experience working with enterprises in a variety of industries and in-depth knowledge of the UAE’s AML/CFT regulatory landscape. We are dedicated to providing companies with personalized, effective, and compliant customer due diligence solutions that assist them in mitigating the risks of money laundering and terrorism financing.

A successful AML/CFT compliance program in the UAE requires effective Know Your Customer (KYC), Enhanced Due Diligence (EDD), and Customer Due Diligence (CDD) processes. Chartered AML Consultants provide complete KYC, EDD, and CDD services that are tailored to the specific needs and requirements of firms in a variety of industries.

By working with us, you can ensure that your company’s customer due diligence processes are rigorous, in accordance with UAE rules, and successful in limiting the dangers of money laundering and terrorism funding.

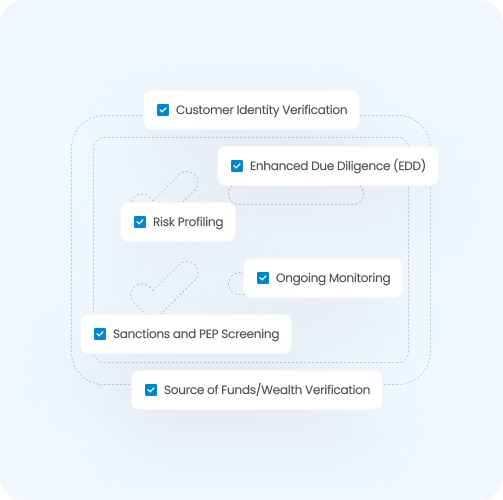

Verifying your clients’ identities and gathering the essential information to determine their risk profile.

Conducting extensive due diligence on high-risk customers, such as politically exposed individuals (PEPs) and customers from high-risk jurisdictions.

Constantly monitoring client transactions and relationships to detect any changes in risk profile or suspicious activity.

Implementing a risk-based approach to customer due diligence, ensuring that the level of due diligence is proportionate to the customer’s risk profile.

Ensure your business is fully protected and compliant with a strong AML/CFT framework.

Verifying your clients’ identities and gathering the essential information to determine their risk profile.

Conducting extensive due diligence on high-risk customers, such as politically exposed individuals (PEPs) and customers from high-risk jurisdictions.

Constantly monitoring client transactions and relationships to detect any changes in risk profile or suspicious activity.

Implementing a risk-based approach to customer due diligence, ensuring that the level of due diligence is proportionate to the customer’s risk profile.

By working with Chartered AML Consultants, you can ensure the security and compliance of your business while minimizing the risks of financial crime

We tailor our services to meet the unique needs and requirements of your organization.

Our team has extensive experience and knowledge of the UAE’s AML/CFT regulatory reporting requirements.

We provide ongoing support to help you stay up-to-date with any changes in regulatory reporting requirements.

We ensure that your regulatory reports are submitted on time, adhering to the UAE’s specific deadlines.

Our Regulatory Reporting service covers a wide range of AML/CFT reports required by the UAE authorities, including Suspicious Transaction Reports (STRs), Suspicious Activity Reports (SARs), Real Estate Activity Report (REAR), Fund Freeze Report (FFR) other reports as mandated by the regulators.

Our expert team ensures that your regulatory reports are accurate, comprehensive, and compliant with the UAE’s specific AML/CFT reporting requirements. By submitting accurate and timely reports, your organization reduces the risk of penalties and fines related to non-compliance.

Our team closely monitors updates and changes in the UAE’s AML/CFT regulatory landscape. We maintain open lines of communication with regulatory authorities and participate in industry events to stay informed about the latest developments. This allows us to provide you with the most up-to-date guidance and support in your regulatory reporting efforts.

Don’t let regulatory reporting challenges hinder your organization’s compliance efforts. Trust Chartered AML Consultants to provide accurate, timely, and compliant AML/CFT regulatory reporting services in the UAE. Contact us today to learn how our expertise can simplify your reporting process and help you maintain compliance with the UAE’s AML/CFT regulations.