Develop and implement robust AML/CFT policies, procedures, and internal controls to ensure your organization’s compliance with regulatory requirements.

Equip your staff with the necessary knowledge and skills to effectively manage AML/CFT risks through our comprehensive training programs.

Assess and identify potential risks associated with money laundering and terrorist financing in your organization with our expert AML risk assessment services

Ensure timely and accurate reporting of your organization’s AML/CFT activities to the relevant regulatory authorities with our assistance.

Regularly review and update your organization’s AML/CFT risk profile with our annual risk assessment services, ensuring ongoing compliance and risk mitigation.

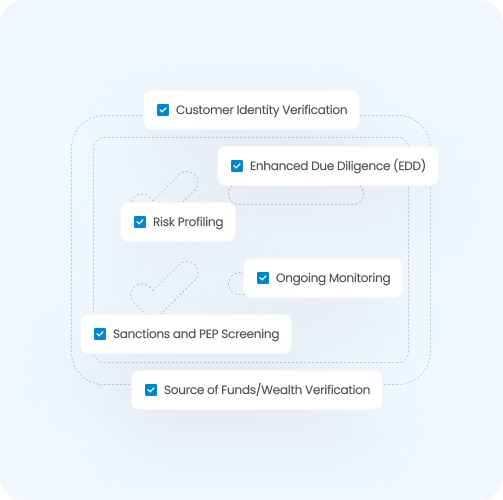

Implement strong customer due diligence processes, including Know Your Customer (KYC) and Enhanced Due Diligence (EDD) procedures, to minimize the risks of money laundering in accordance with UAE rules, and successful in limiting the dangers of money laundering and terrorism funding.

Ensure compliance with global sanctions lists through our comprehensive screening and verification services tailored to your business needs.

Identify potential gaps in your anti-money laundering protocols with our thorough AML audit services, ensuring regulatory compliance and risk mitigation

Protect your business with enhanced due diligence through our Politically Exposed Persons (PEP) verification services, reducing the risk of financial crime.

Establish a fully compliant in-house compliance department in the UAE, tailored to meet local regulations and international standards.

Explore answers to common questions about our anti-money laundering services and how we can assist your business.

The most common AML violations that businesses commit include failure to conduct proper due diligence on customers and transactions, failure to report suspicious activities to the relevant authorities, and failure to maintain accurate records. Other common violations include inadequate AML training and awareness programs and insufficient internal controls to prevent money laundering activities.

In the UAE, AML (Anti-Money Laundering) services are crucial for a wide range of businesses and industries that are at risk of financial crime. These include:

All Designated Non-Financial Businesses and Professions (DNFBPs) operating in the UAE, including consultants, trust companies, and insurance providers, are also obligated to comply with AML laws to protect their businesses from financial crimes.

Failing to comply with AML regulations in the UAE can have severe consequences, including:

At CAMC, we tailor AML compliance services to meet the specific needs of your business by conducting a thorough risk assessment to identify your vulnerabilities. We offer:

Don’t leave your business exposed to the risks of money laundering and terrorist financing. Get in touch with our expert team at Chartered AML Consultants for a consultation and discover how we can help you achieve AML/CFT compliance with confidence.