Comprehensive AML/CFT Policy in UAE

Comprehensive AML/CFT Policy, Procedures & Controls Documentation Services in the UAE At Chartered AML Consultants, we specialize in aiding organizations of all sizes in laying the foundations for AML/CFT compliance. Our specialists work with your business to create complete policies, procedures, and controls that address your specific risks and operational requirements. Our Expertise in Building […]

About Chartered AML Consultants

Leading Anti-Money Laundering Consultants for DNFBPs in the UAE Chartered AML Consultants is a leading AML firm in the UAE. We specialize in comprehensive compliance solutions for DNFBPs. Our expertise ensures businesses stay ahead in regulatory requirements and risk management. Explore Our Mission, Vision and Core Values at Chartered AML Consultants Discover how our mission, […]

Effective AML Training Programs

AML/CFT Laws in the UAE: Ensuring Financial Stability The United Arab Emirates (UAE) is recognized as a major financial hub in the Middle East, connecting markets across Asia, Europe, and Africa. Due to its significant position in the global financial system, the UAE has been a target for money laundering and terrorism financing. To counter […]

AML Strategies for NBFIs

Non-Bank Financial Institutions (NBFIs) play a critical role in the financial ecosystem by providing services such as lending, insurance, and asset management. However, their unique structure and operations make them vulnerable to money laundering activities. Implementing Anti-Money Laundering (AML) strategies is essential to protect NBFIs from being exploited by criminal entities. This article delves into […]

Layering in Money Laundering

Layering is the second stage of the money laundering process, where illicit funds are deliberately moved, spread, or disguised to make tracking them difficult for authorities. It is a crucial step for money launderers, as it distances the illegal proceeds from their source, making detection by law enforcement more challenging. Understanding the layering process is […]

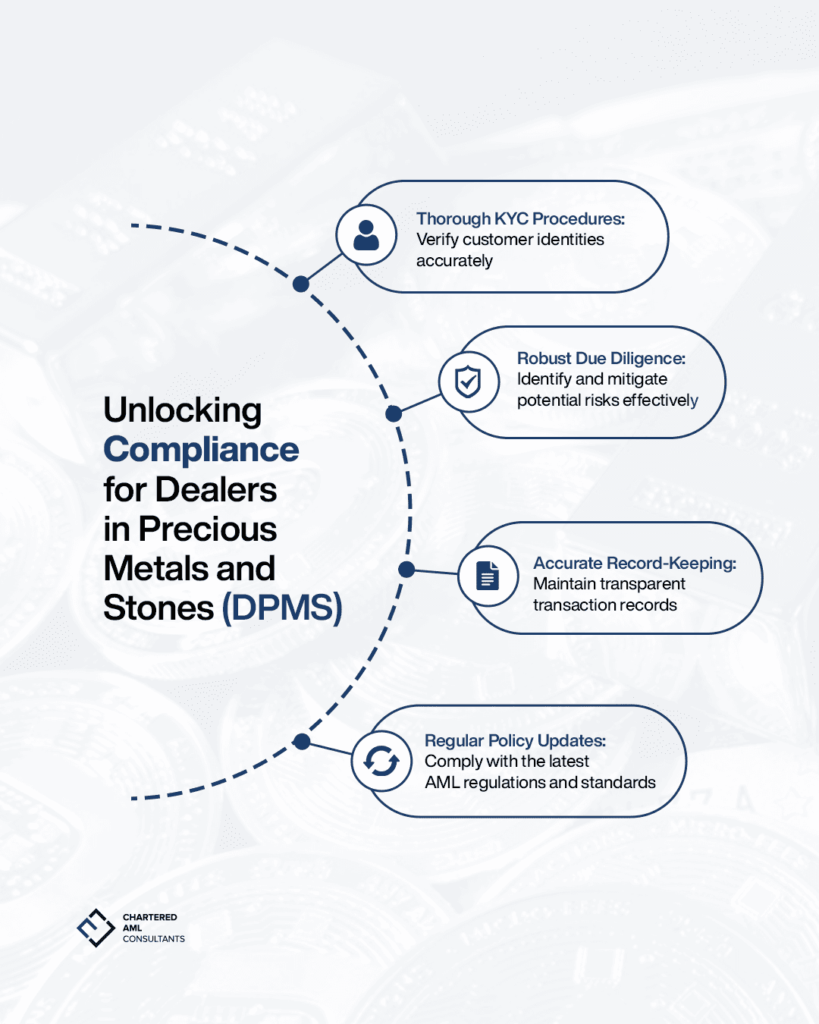

Unlocking Compliance for Dealers in Precious Metals and Stones (DPMS)

Dealers in Precious Metals and Stones (DPMS) face unique challenges in maintaining compliance with Anti-Money Laundering (AML) regulations. Ensuring compliance not only protects your business from legal repercussions but also enhances your reputation in the industry. In this blog post, we will delve into the essential compliance measures every DPMS should implement. Thorough KYC Procedures […]

FATF Grey List Update: June 2024

On June 28, 2024, Jamaica and Türkiye have been removed from the FATF Grey List, also known as Jurisdiction under Increased Monitoring list, which includes countries that are actively working with the FATF to address strategic deficiencies in their regimes to counter money laundering, terrorist financing, and proliferation financing. This FATF Grey List update highlights […]

AML Challenges in the Real Estate Sector: Best Practices for Compliance

Anti-Money Laundering (AML) compliance is critical in the real estate sector to prevent financial crimes. Real estate transactions often involve large sums of money, making the sector an attractive target for money launderers. In this blog post, we will explore the common AML challenges in the real estate sector and provide best practices to enhance […]