Introduction

As the United Arab Emirates (UAE) continues to strengthen its regulatory framework to combat money laundering and terrorist financing, compliance with Anti-Money Laundering (AML) regulations has become a priority for businesses across sectors. One of the most crucial steps for businesses operating in the UAE is AML registration. This registration process involves multiple steps to ensure compliance with the UAE’s stringent AML laws, which align with international standards set by the Financial Action Task Force (FATF).

This guide provides a comprehensive, step-by-step overview of the AML registration process in the UAE, highlighting the importance of compliance, the registration steps, and best practices to ensure adherence to regulatory requirements.

What is AML Registration?

AML registration refers to the process by which businesses, particularly those operating in high-risk sectors such as banking, real estate, and designated non-financial businesses and professions (DNFBPs), register with the UAE authorities to comply with AML and Counter-Terrorist Financing (CTF) requirements. Registration ensures that companies are subject to appropriate oversight, adhere to the necessary due diligence measures, and have processes in place to identify and report suspicious activities.

AML registration is a critical step for businesses in the UAE as it demonstrates a commitment to regulatory compliance and mitigates the risk of involvement in money laundering or terrorist financing activities.

Importance of AML Registration in UAE

1. Compliance with Regulatory Requirements

The UAE has established stringent AML regulations to combat financial crimes. AML registration is mandatory for certain sectors, including banks, insurance companies, and real estate developers. Registration ensures that these businesses comply with FATF recommendations and the UAE’s AML/CTF laws, thereby contributing to a secure financial environment.

Non-compliance can result in severe penalties, including heavy fines, license suspension, and even imprisonment. By registering for AML, businesses demonstrate their commitment to maintaining ethical standards and complying with local regulations.

2. Mitigating Financial Crime Risks

AML registration is essential for mitigating the risks associated with financial crimes. It involves implementing internal controls, due diligence measures, and monitoring systems that help identify suspicious transactions and prevent money laundering. For example, financial institutions are required to report Suspicious Activity Reports (SARs) and Suspicious Transaction Reports (STRs) through the UAE’s goAML platform.

Learn more about reporting requirements through our Regulatory Reporting Services.

3. Enhancing Business Reputation

AML registration also plays a significant role in enhancing a company’s reputation. Businesses that are compliant with AML regulations are perceived as trustworthy and reliable by customers, investors, and regulatory authorities. This trust can lead to improved business relationships and increased opportunities for growth.

Step-by-Step Guide to AML Registration in the UAE

1. Determine if Your Business Needs to Register

The first step in the AML registration process is determining whether your business is required to register. The UAE mandates AML compliance for businesses operating in sectors such as banking, real estate, precious metals trading, and other high-risk sectors. If your business falls under one of these categories, you must proceed with AML registration.

2. Appoint a Compliance Officer

To comply with AML requirements, businesses must appoint a Compliance Officer responsible for overseeing AML procedures, monitoring transactions, and reporting suspicious activities to the Financial Intelligence Unit (FIU). The Compliance Officer acts as the main point of contact between the business and regulatory authorities.

For more information on setting up a compliance department, explore our Compliance Department Setup Services.

3. Register with the Relevant Authority

Depending on your business type, you may need to register with different regulatory bodies, such as the Central Bank of the UAE, the Securities and Commodities Authority (SCA), or the Dubai Financial Services Authority (DFSA). Registration involves submitting relevant documents, such as the business license, identification documents for owners, and information about the appointed Compliance Officer.

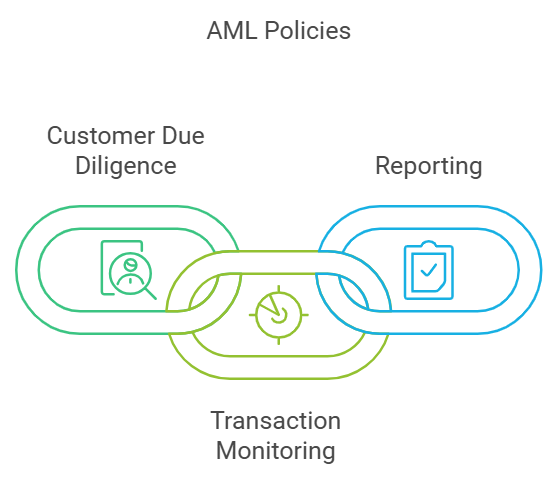

4. Submit AML Policy and Procedures

As part of the registration process, businesses must develop and submit their AML policy and procedures. These documents outline how the business will comply with AML requirements, including customer due diligence, transaction monitoring, and reporting suspicious activities. The policy must be tailored to the specific risks associated with the business and must be regularly updated.

5. Register on the goAML Platform

The goAML platform is an online reporting tool developed by the United Nations Office on Drugs and Crime (UNODC) for the UAE FIU. Businesses must register on goAML to report any suspicious transactions. The registration process involves submitting the required documents, creating user accounts, and gaining approval from the FIU.

Learn more about registering on goAML through our guide on goAML Compliance.

6. Conduct Customer Due Diligence (CDD)

Once registered, businesses must implement Customer Due Diligence (CDD) measures to identify and verify the identity of customers before establishing business relationships. CDD involves collecting information such as identification documents, proof of address, and information on the purpose of the business relationship.

For high-risk customers, businesses must conduct Enhanced Due Diligence (EDD), which involves more in-depth verification and scrutiny. Learn more about EDD in our blog on Enhanced Due Diligence in the UAE.

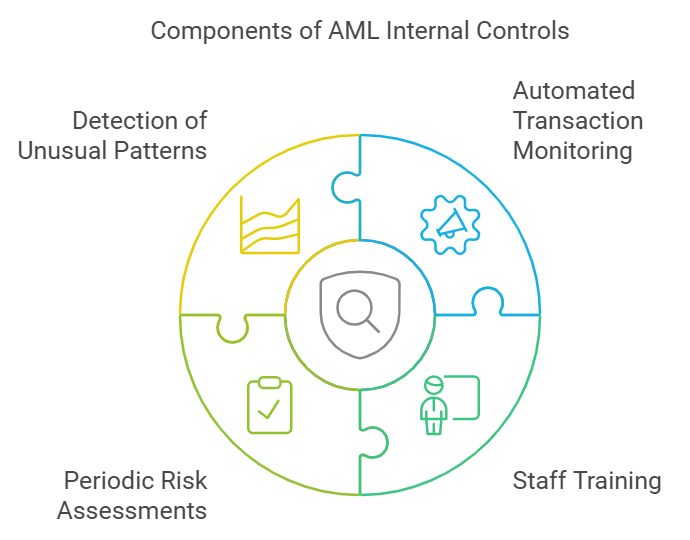

7. Implement Internal Controls and Monitoring Systems

Businesses must establish internal controls and monitoring systems to detect suspicious activities and ensure compliance with AML regulations. These controls include automated transaction monitoring systems, staff training, and periodic risk assessments. Monitoring systems help identify unusual patterns, such as large cash deposits or transactions involving high-risk jurisdictions.

8. Ongoing Compliance and Reporting

AML compliance is an ongoing process that requires continuous monitoring and reporting. Businesses must file SARs and STRs through the goAML platform whenever suspicious activities are identified. Additionally, companies must conduct regular audits to ensure that their AML procedures are effective and comply with regulatory requirements.

For support in maintaining ongoing compliance, explore our AML Compliance Services.

9. Training and Awareness

Staff training is an essential part of AML compliance. Businesses must provide training programs to educate employees about AML regulations, identifying suspicious activities, and understanding the company’s AML policies. Regular training ensures that employees are well-prepared to identify and respond to potential risks.

10. Renew AML Registration Periodically

AML registration is not a one-time process. Businesses must renew their registration periodically to remain compliant with updated regulations. The renewal process involves submitting updated documents and confirming that all AML procedures are in place and effective.

Challenges in AML Registration in the UAE

1. Complex Regulatory Requirements

The UAE’s regulatory environment is complex, with different rules for different sectors. Navigating these regulations can be challenging, especially for businesses that are new to the UAE market. It is important for businesses to work with experienced compliance professionals to ensure that they meet all regulatory requirements.

2. Resource Constraints

AML registration and compliance require significant resources, including personnel, time, and financial investments. Smaller businesses may face challenges in appointing a dedicated Compliance Officer or implementing monitoring systems. Engaging external consultants can help mitigate these challenges.

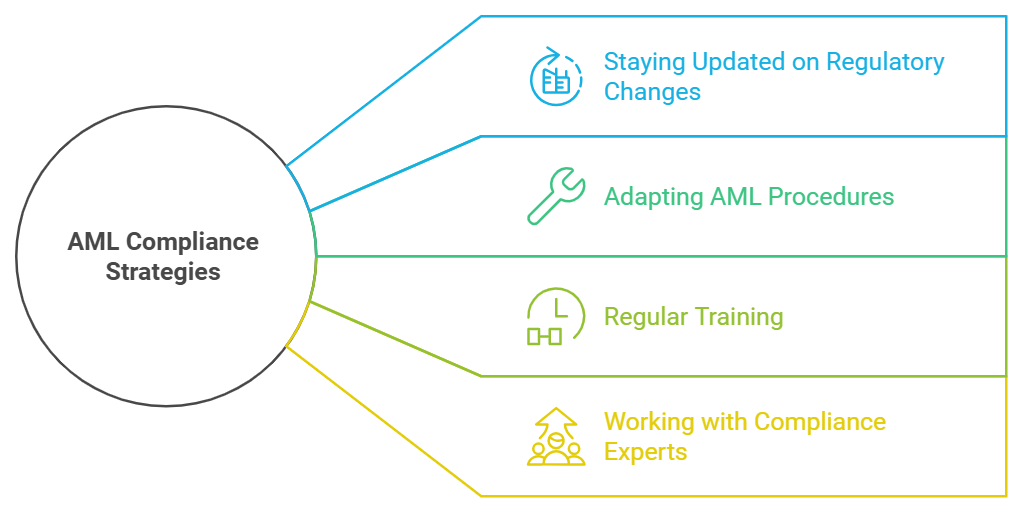

3. Keeping Up with Regulatory Changes

AML regulations are constantly evolving to address emerging risks. Businesses must stay updated on regulatory changes and adapt their AML procedures accordingly. Regular training and working with compliance experts can help businesses stay informed and compliant.

Best Practices for AML Registration and Compliance

1. Develop a Risk-Based Approach

Adopting a risk-based approach to AML compliance allows businesses to allocate their resources more effectively. By categorizing customers based on their risk level, companies can focus their efforts on high-risk clients and ensure that appropriate measures are in place to mitigate risks.

2. Engage Experienced Compliance Consultants

Working with experienced AML consultants can significantly enhance the effectiveness of the registration and compliance process. Consultants can provide guidance on regulatory requirements, assist with policy development, and ensure that all procedures are implemented correctly.

3. Leverage Technology for Compliance

Using technology, such as automated monitoring tools and transaction screening systems, can streamline the AML compliance process. Technology helps identify suspicious activities more efficiently, reduces the risk of human error, and ensures that businesses are compliant with regulatory requirements.

4. Maintain Detailed Records

Maintaining detailed records of all AML activities is crucial for regulatory compliance. Businesses must keep records of customer identification, transaction monitoring, and reports submitted to the FIU. Detailed records provide evidence of compliance and can help businesses demonstrate their efforts during regulatory audits.

How CAMC Can Assist with AML Registration

Chartered AML Consultants (CAMC) offers comprehensive support for AML registration and compliance in the UAE. Our services include:

1. Registration Assistance

We assist businesses with the entire AML registration process, from determining if registration is required to submitting documents and gaining approval from regulatory authorities.

2. AML Policy Development

Our team helps businesses develop tailored AML policies that align with regulatory requirements and best practices. Our policies cover all aspects of AML compliance, including customer due diligence, transaction monitoring, and reporting.

3. Compliance Training Programs

We offer AML compliance training programs to educate employees about regulatory requirements, identifying suspicious activities, and implementing effective AML procedures.

4. Ongoing Compliance Support

Our ongoing compliance support services include monitoring transactions, conducting risk assessments, and assisting with SAR/STR filings. We help businesses maintain compliance with AML regulations and stay updated on regulatory changes.

Conclusion

AML registration is a crucial step for businesses operating in high-risk sectors in the UAE. It ensures compliance with the country’s stringent AML regulations, helps mitigate financial crime risks, and enhances business reputation. By following the step-by-step guide outlined in this blog, businesses can navigate the AML registration process successfully and maintain compliance with regulatory requirements.

Partnering with CAMC can make the AML registration and compliance process more efficient and effective. Our team of experts provides tailored support to help businesses navigate the complexities of AML regulations and achieve their compliance objectives.

For more information on how CAMC can assist with AML registration and compliance,

References

UAE FIU (Financial Intelligence Unit) – Reporting Requirements

https://www.uaefiu.gov.ae

AML Software Solutions – CAMC Overview

https://camc.ae/services/aml-cft-regulatory-reporting-uae/

World Bank – Anti-Money Laundering Overview

https://www.worldbank.org/en/topic/financialsector/brief/anti-money-laundering