Introduction

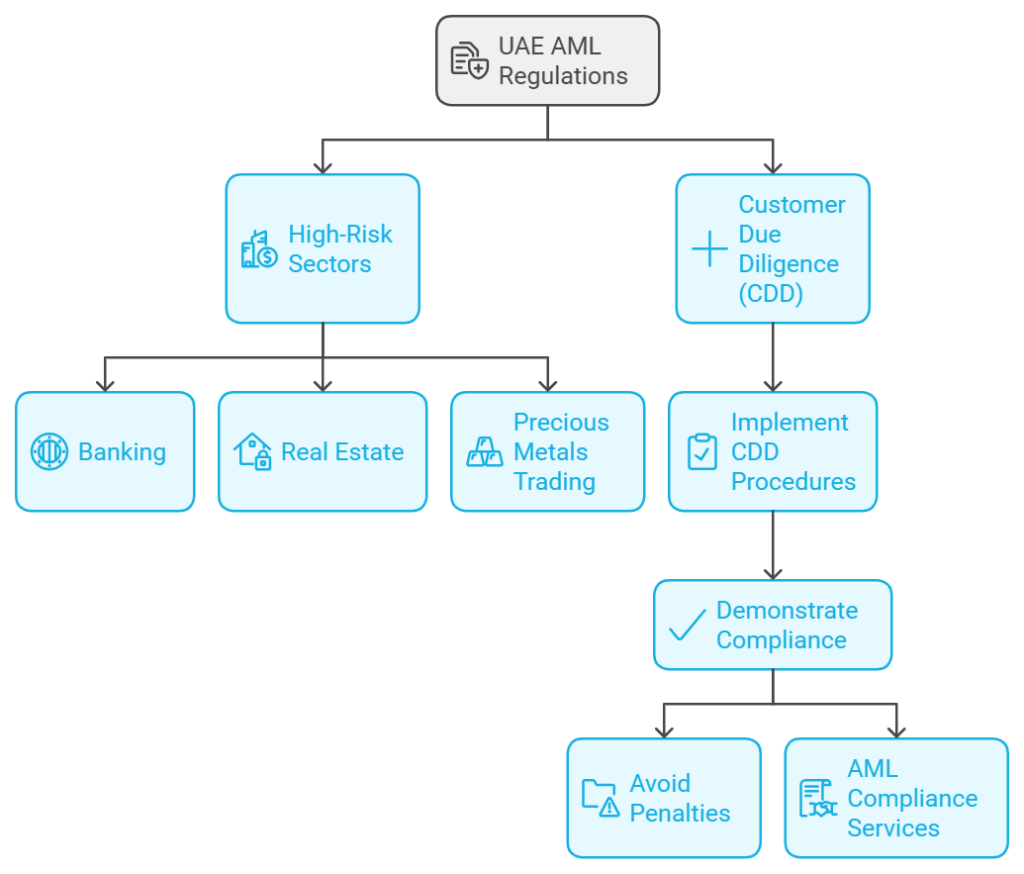

In today’s globalized financial landscape, regulatory compliance is more important than ever for businesses, particularly those operating in high-risk industries. One of the most fundamental aspects of Anti-Money Laundering (AML) compliance is Customer Due Diligence (CDD), which involves identifying and verifying the identities of customers to assess the risk they may pose. In the United Arab Emirates (UAE), CDD plays a pivotal role in ensuring compliance with local AML regulations and mitigating the risks associated with money laundering and terrorist financing.

This blog will provide an in-depth overview of CDD, its significance in the UAE’s AML landscape, and the steps businesses can take to implement effective CDD procedures.

What is Customer Due Diligence (CDD)?

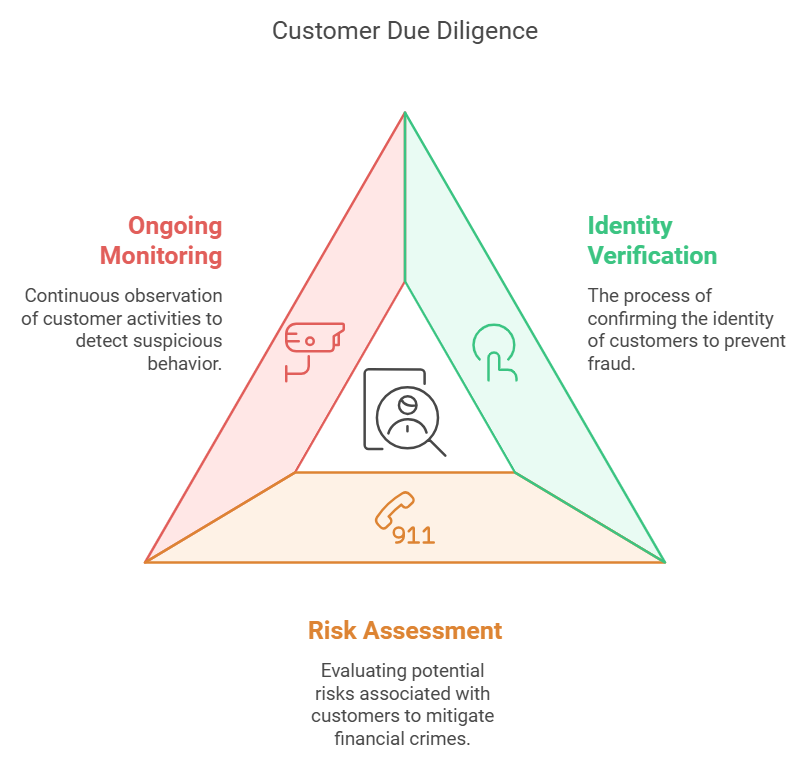

Customer Due Diligence (CDD) is the process by which financial institutions and businesses gather information about their customers to evaluate and mitigate risks associated with financial crimes. CDD is a critical component of AML compliance and requires businesses to perform identity verification, risk assessment, and ongoing monitoring of customers.

In the UAE, CDD is essential for complying with FATF (Financial Action Task Force) recommendations and local AML regulations. It is applied to all customers, regardless of their risk level, and helps businesses develop a thorough understanding of their clients, thereby preventing money laundering and other financial crimes.

Key Components of Customer Due Diligence

1. Customer Identification and Verification

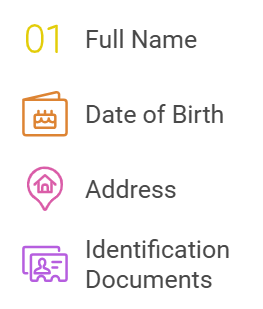

The first step in the CDD process involves identifying and verifying the identity of the customer. This requires collecting personal information, such as:

- Full name

- Date of birth

- Address

- National identification documents (e.g., Emirates ID, passport)

For businesses, this process may also involve verifying the company’s legal structure, ownership, and registration status.

2. Risk Assessment

Once the customer’s identity has been verified, the next step is to conduct a risk assessment. This involves evaluating the customer’s profile and determining their level of risk for potential involvement in money laundering or terrorist financing. Risk assessments are based on factors such as the customer’s location, type of business activity, transaction patterns, and whether they are classified as a Politically Exposed Person (PEP).

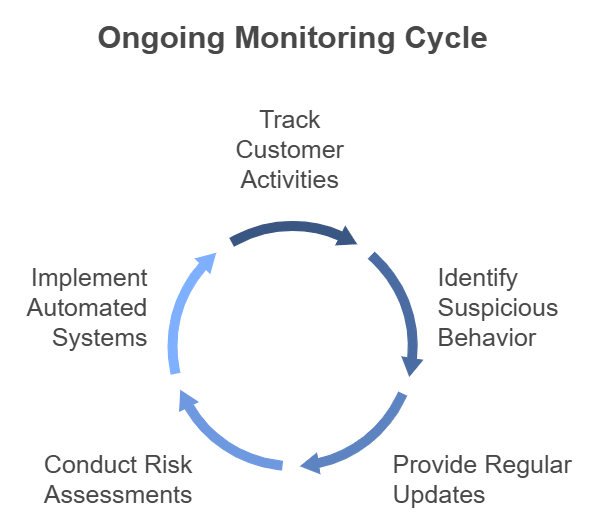

3. Ongoing Monitoring

CDD is not a one-time process—it involves ongoing monitoring of customer activities to identify any suspicious transactions or changes in customer behavior. Businesses must regularly update customer information and ensure that they are aware of any significant changes that may impact the customer’s risk level.

Learn more about the importance of ongoing monitoring through our Transaction Monitoring Services.

The Importance of CDD in UAE AML Compliance

1. Regulatory Compliance

The UAE has implemented stringent AML regulations to ensure compliance with FATF recommendations and combat money laundering and terrorist financing. CDD is a fundamental requirement for businesses in the UAE, particularly those operating in high-risk sectors such as banking, real estate, and precious metals trading. By implementing effective CDD procedures, businesses can demonstrate compliance with local regulations and avoid significant penalties and fines for non-compliance.

Explore our AML Compliance Services to understand how CAMC can help you stay compliant.

2. Risk Mitigation

CDD plays a crucial role in mitigating the risk of financial crimes. By conducting thorough due diligence on customers, businesses can identify potential red flags, such as customers from high-risk jurisdictions or those with a history of adverse media. This enables businesses to take proactive measures to mitigate the risk of being involved in money laundering or terrorist financing.

3. Building Trust and Business Reputation

CDD also contributes to building trust and enhancing a company’s reputation. Customers and investors are more likely to do business with companies that prioritize compliance and take proactive measures to prevent financial crimes. By implementing effective CDD procedures, businesses can build stronger relationships with their clients and enhance their credibility in the market.

4. Preventing Financial Crimes

The primary objective of CDD is to prevent financial crimes such as money laundering, terrorist financing, and fraud. By thoroughly verifying customer identities and conducting risk assessments, businesses can identify and mitigate potential risks before they escalate. CDD also helps detect suspicious activities, such as unusual transaction patterns or attempts to conceal the origin of funds.

5. Enhancing International Collaboration

CDD also plays a key role in enhancing international collaboration in the fight against financial crime. By implementing rigorous CDD practices, businesses in the UAE contribute to a global effort to prevent money laundering and terrorist financing. Effective CDD ensures that businesses comply with international standards and are able to collaborate with international financial institutions and regulatory bodies.

Challenges in Implementing Customer Due Diligence

1. Complexity of Customer Profiles

One of the challenges businesses face when implementing CDD is the complexity of customer profiles. For high-risk customers, such as PEPs or clients from high-risk jurisdictions, gathering and verifying information can be time-consuming and resource-intensive. Additionally, complex ownership structures and cross-border transactions can further complicate the due diligence process.

2. Keeping Up with Regulatory Changes

AML regulations in the UAE are constantly evolving, and businesses must stay up to date with these changes to remain compliant. This requires regular training and updates to internal procedures to ensure that CDD processes align with current regulatory requirements. Failure to stay updated can result in compliance gaps, penalties, and reputational damage.

3. Balancing Compliance with Customer Experience

While CDD is essential for regulatory compliance, it can sometimes create friction in the customer onboarding process. Businesses must strike a balance between gathering the necessary information for compliance and providing a seamless customer experience. Excessive documentation requests and lengthy verification processes can lead to customer dissatisfaction and impact business growth.

4. Limited Access to Reliable Information

Another challenge businesses face is the limited access to reliable information when conducting due diligence on customers. This is particularly relevant for clients from jurisdictions with limited transparency or inadequate regulatory frameworks. Businesses need to utilize third-party databases, government records, and other verification tools to obtain accurate and trustworthy information about their customers.

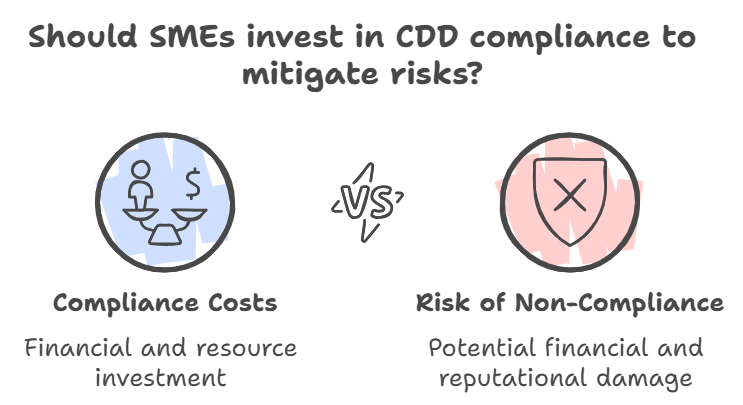

5. High Costs of Compliance

Implementing effective CDD procedures can be resource-intensive and costly, especially for small and medium-sized enterprises (SMEs). The costs associated with compliance include employee training, purchasing verification tools, and dedicating staff to conduct due diligence. However, businesses must weigh these costs against the potential financial and reputational risks of non-compliance.

Best Practices for Effective Customer Due Diligence

1. Develop a Risk-Based Approach

Adopting a risk-based approach to CDD allows businesses to allocate resources more effectively. Customers should be categorized based on their risk profiles, with enhanced due diligence applied to high-risk clients and standard due diligence for low-risk clients. This approach ensures that businesses focus their efforts on clients that pose the highest risk. High-risk customers may require more frequent reviews, additional documentation, and ongoing monitoring to mitigate potential threats.

For more information on risk-based approaches, explore our Enhanced Due Diligence Services.

2. Utilize Advanced Technology for Monitoring

Leveraging advanced technology, such as automated transaction monitoring systems and AI-driven compliance tools, can enhance the effectiveness of CDD. These tools help businesses monitor customer activities in real-time and identify any unusual or suspicious behavior that may indicate financial crime. Automated tools reduce human error, improve efficiency, and ensure that potential risks are flagged and addressed promptly.

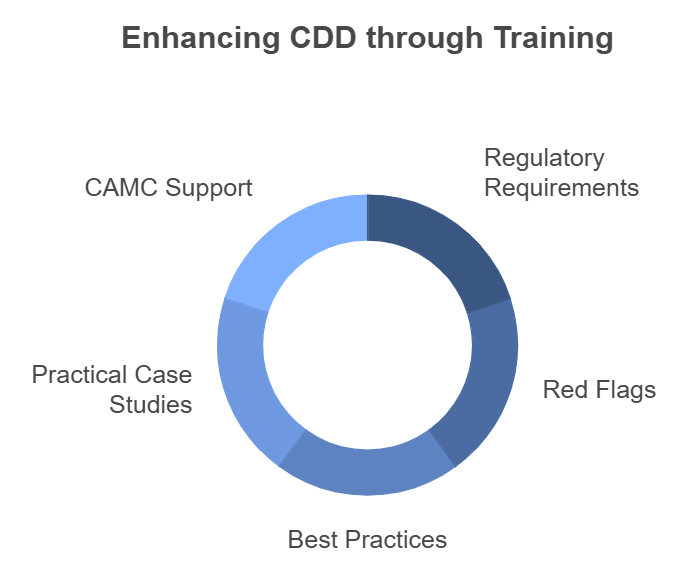

3. Train Employees on CDD Requirements

Training is a critical component of effective CDD implementation. Employees responsible for customer onboarding and compliance must be well-trained on regulatory requirements, red flags, and best practices for conducting due diligence. Regular training ensures that employees are aware of the latest AML requirements and are equipped to identify suspicious activities. Training should also include practical case studies and examples to help employees understand how to apply CDD in real-world scenarios.

Explore our AML Compliance Training Services to learn how CAMC can support your training needs.

4. Engage Compliance Experts

For businesses that lack the internal resources or expertise to conduct effective CDD, engaging external compliance experts can be beneficial. Compliance consultants can provide the necessary guidance and support to ensure that CDD procedures are implemented correctly and meet regulatory requirements. External experts can also conduct independent reviews of existing CDD practices and recommend improvements to enhance compliance.

5. Maintain Comprehensive Records

Maintaining comprehensive records is essential for demonstrating compliance with CDD requirements. Businesses must keep detailed records of all customer information, risk assessments, verification steps, and any red flags identified during the due diligence process. These records should be easily accessible for review by regulatory authorities and should be updated regularly to reflect any changes in the customer’s profile or risk level.

6. Establish Clear Policies and Procedures

Businesses should establish clear policies and procedures for conducting CDD. These policies should outline the steps involved in customer identification, risk assessment, and ongoing monitoring. Establishing standardized procedures ensures consistency in CDD practices and reduces the risk of compliance gaps. Policies should be reviewed regularly and updated to reflect changes in regulatory requirements and best practices.

How CAMC Can Assist with Customer Due Diligence

Chartered AML Consultants (CAMC) offers comprehensive CDD services to help businesses comply with UAE AML regulations and mitigate financial crime risks. Our services include:

1. Customer Identification and Verification

We assist businesses in verifying customer identities and gathering the necessary information to comply with regulatory requirements. Our team uses advanced verification tools to ensure that customer information is accurate and reliable.

2. Risk Assessment and Categorization

CAMC provides risk assessment services to help businesses categorize customers based on their risk profiles. By identifying high-risk clients, businesses can take proactive measures to mitigate potential risks. Our risk assessment services include in-depth analysis of customer profiles, transaction patterns, and geographic risk factors.

3. Ongoing Monitoring and Reporting

Our ongoing monitoring services help businesses keep track of customer activities and identify any suspicious behavior. We provide regular updates, risk assessments, and support to ensure that businesses remain compliant with AML regulations. CAMC also assists businesses in implementing automated monitoring systems to streamline the ongoing monitoring process.

4. Training Programs for CDD Compliance

CAMC offers training programs to educate employees on CDD requirements, red flags, and best practices for effective compliance. Our training programs are tailored to the specific needs of each business and ensure that employees are well-equipped to conduct due diligence effectively. Training sessions include interactive workshops, case studies, and assessments to ensure employees understand and can apply CDD principles.

Conclusion

Customer Due Diligence (CDD) is a fundamental component of AML compliance in the UAE. It helps businesses identify and mitigate risks, comply with regulatory requirements, and build trust with customers and investors. By implementing effective CDD procedures, businesses can protect themselves from financial crime, enhance their reputation, and contribute to the broader goals of financial stability and transparency in the UAE.

Effective CDD requires a combination of well-trained staff, advanced technology, comprehensive record-keeping, and a risk-based approach. Businesses must remain proactive in updating their CDD practices to reflect changes in regulatory requirements and emerging threats. By doing so, they can ensure compliance, mitigate risks, and foster a secure financial environment.

Partnering with CAMC can make the CDD process more efficient and effective. Our team of experts provides tailored CDD services to help businesses navigate the complexities of AML compliance and achieve their compliance objectives. With CAMC’s support, businesses can enhance their due diligence practices and contribute to the fight against financial crime.

For more information on how CAMC can assist with customer due diligence, contact us today.

References

OECD – Politically Exposed Persons (PEPs) in AML

https://www.oecd.org/corruption/anti-bribery/PEPs-in-AML

Basel Institute on Governance – AML Index

https://baselgovernance.org/basel-aml-index

United Arab Emirates Ministry of Finance – AML/CFT Guidelines

https://www.mof.gov.ae/en/resourcesAndBudget/Pages/aml-cft.aspx