Introduction

Imagine a scenario where a high-net-worth individual opens a bank account with a substantial deposit, only for those funds to later be discovered as linked to money laundering activities. In today’s financial landscape, where the integrity of transactions is paramount, such occurrences underscore the critical need for Enhanced Due Diligence (EDD). This advanced risk assessment process stands as a formidable defense mechanism, ensuring financial institutions can mitigate potential crimes like money laundering and terrorist financing efficiently. As we navigate the complexities of Anti-Money Laundering (AML) compliance, understanding EDD’s role becomes essential for financial professionals across the board.

What is Enhanced Due Diligence?

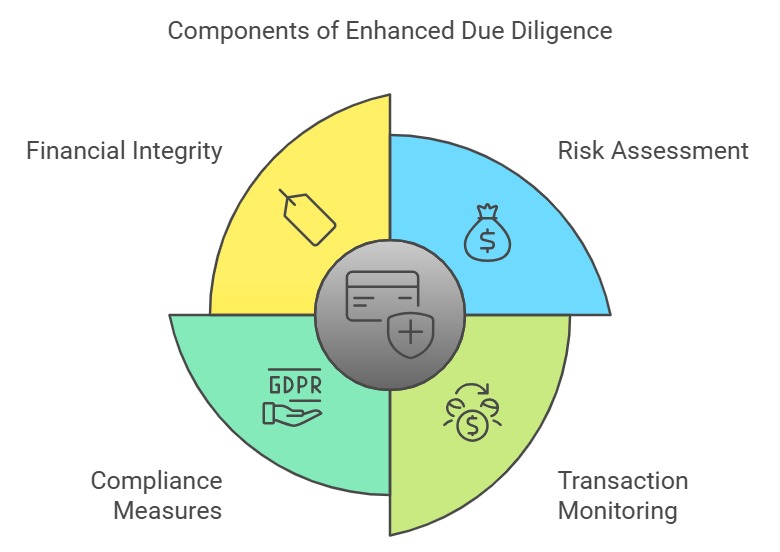

Enhanced Due Diligence (EDD) goes beyond the scope of standard Customer Due Diligence (CDD). It is an advanced risk assessment technique designed to scrutinize potential business partnerships more deeply and highlight risks that might remain undetected through conventional methods. EDD involves a thorough examination of customer information to identify and assess risks or threats associated with individuals or entities. This process is vital in safeguarding financial institutions against potential financial crimes by providing a comprehensive analysis of various customer attributes.

Scope and Application of EDD

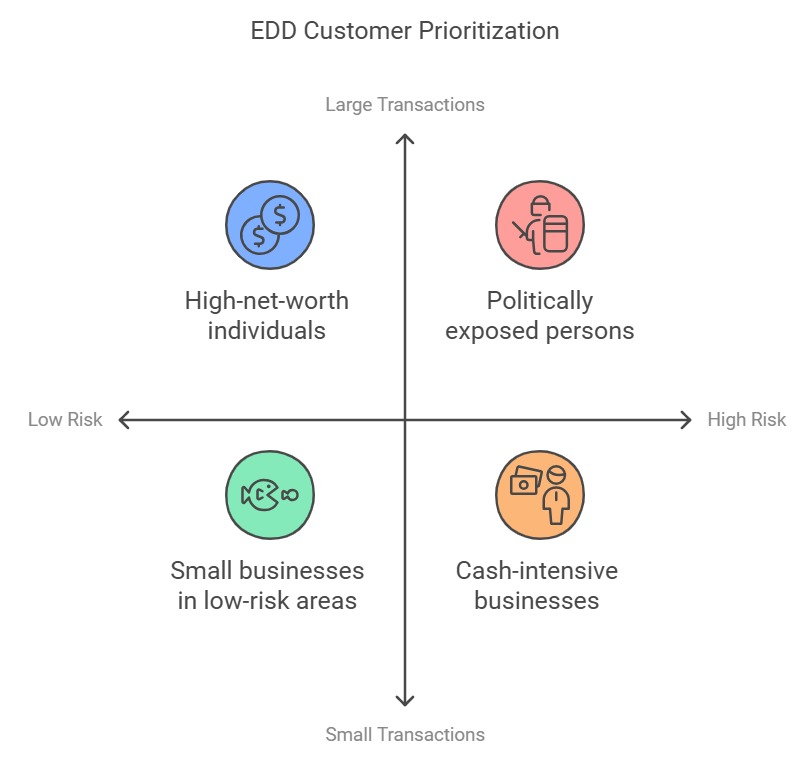

EDD is specifically tailored for high-risk customers, including politically exposed persons (PEPs), businesses in high-risk jurisdictions, and entities involved in cash-intensive sectors. High-net-worth individuals and large transactions also fall under its purview. The process involves collecting comprehensive data, such as the source of funds, beneficial ownership structures, and connections to PEPs. This detailed approach ensures continuous monitoring and periodic reviews to detect changes or emerging risks. By doing so, EDD fortifies the defense against financial crimes, ensuring compliance and security.

Regulatory Compliance and EDD

Aligning with recommendations from the Financial Action Task Force (FATF), EDD emphasizes a risk-based approach tailored to specific AML and Counter-Terrorism Financing (CTF) risks posed by customers. The meticulous documentation and reporting mandated by EDD are crucial for regulatory compliance and transparency. Financial institutions must ensure that regulators have immediate access to enhanced due diligence reports, reinforcing the EDD’s role as a cornerstone of effective AML efforts.

Technological Integration in EDD

Incorporating advanced technological tools and data analytics into EDD is paramount in efficiently gathering and analyzing customer information. Technologies such as transaction pattern analysis, comprehensive background checks, and adverse media reports are pivotal in enhancing the effectiveness and efficiency of risk management processes. By leveraging such technologies, organizations can streamline their operations, improve risk assessments, and ensure regulatory compliance, thereby fortifying their defense against financial crimes.

Key Steps in Conducting EDD

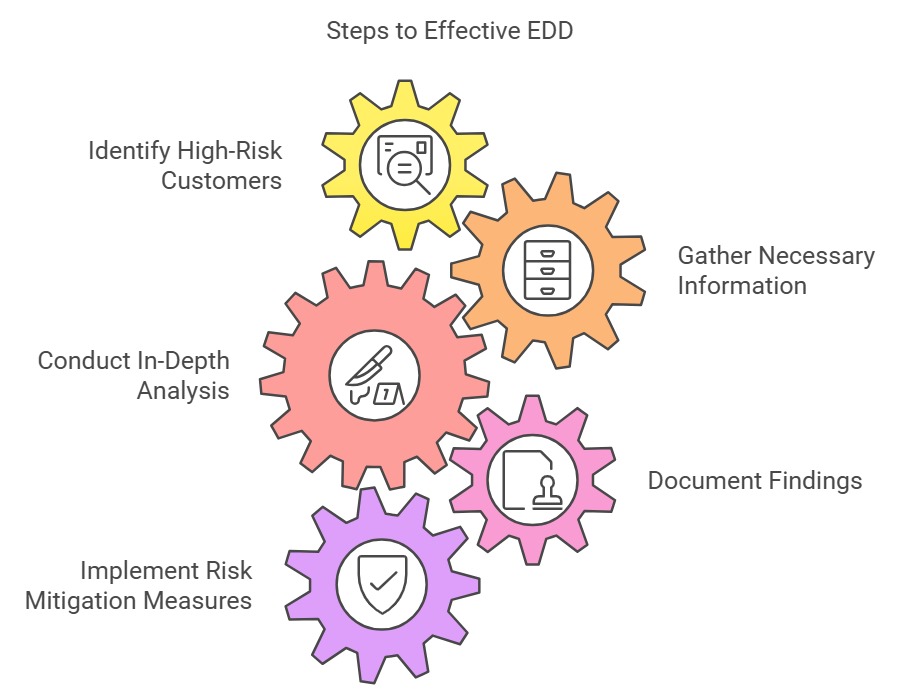

To implement EDD effectively, organizations should adhere to the following steps:

- Identify High-Risk Customers: Establish clear criteria to identify high-risk customers, like PEPs or businesses operating in high-risk jurisdictions.

- Gather Necessary Information: Collect detailed data on customer ownership, source of funds, and business activities.

- Conduct In-Depth Analysis: Thoroughly analyze the gathered information to assess the risk posed by the customer.

- Document Findings: Maintain comprehensive documentation of findings and risk assessments.

- Implement Risk Mitigation Measures: Develop tailored risk profiles and implement appropriate mitigation measures based on identified risks.

By following these steps, businesses can ensure a robust EDD process that aligns with regulatory requirements and effectively mitigates potential financial risks.

Why is EDD Important?

For any business aiming to implement a robust AML program, EDD is indispensable. It significantly enhances AML compliance by providing deeper insights into a customer’s financial assets and activities. By streamlining onboarding and ongoing monitoring processes, EDD allows organizations to address potential issues in real-time. Moreover, it bolsters risk management by gathering additional information about customers and transactions. This comprehensive understanding enables organizations to better comprehend associated risks and detect suspicious activities more effectively, safeguarding their financial integrity.

CAMC’s Role in Achieving EDD

As a leader in compliance and risk management solutions, CAMC is uniquely positioned to support businesses in implementing effective EDD measures. Through our cutting-edge technological tools and expert guidance, we empower organizations to meet AML requirements and protect against financial crimes. By partnering with CAMC, businesses can leverage our expertise to enhance their due diligence processes, ensuring they remain compliant and resilient in an ever-evolving financial landscape.

In the ongoing battle against financial crimes, Enhanced Due Diligence is not merely a regulatory requirement but a vital tool for safeguarding financial institutions and ensuring compliance. By understanding and implementing EDD effectively, businesses can minimize the potential for financial losses, legal penalties, and reputational damage, while ensuring alignment with regulatory demands. As the financial world becomes more complex, embracing EDD and partnering with experts like CAMC is crucial for maintaining integrity and security.