Introduction

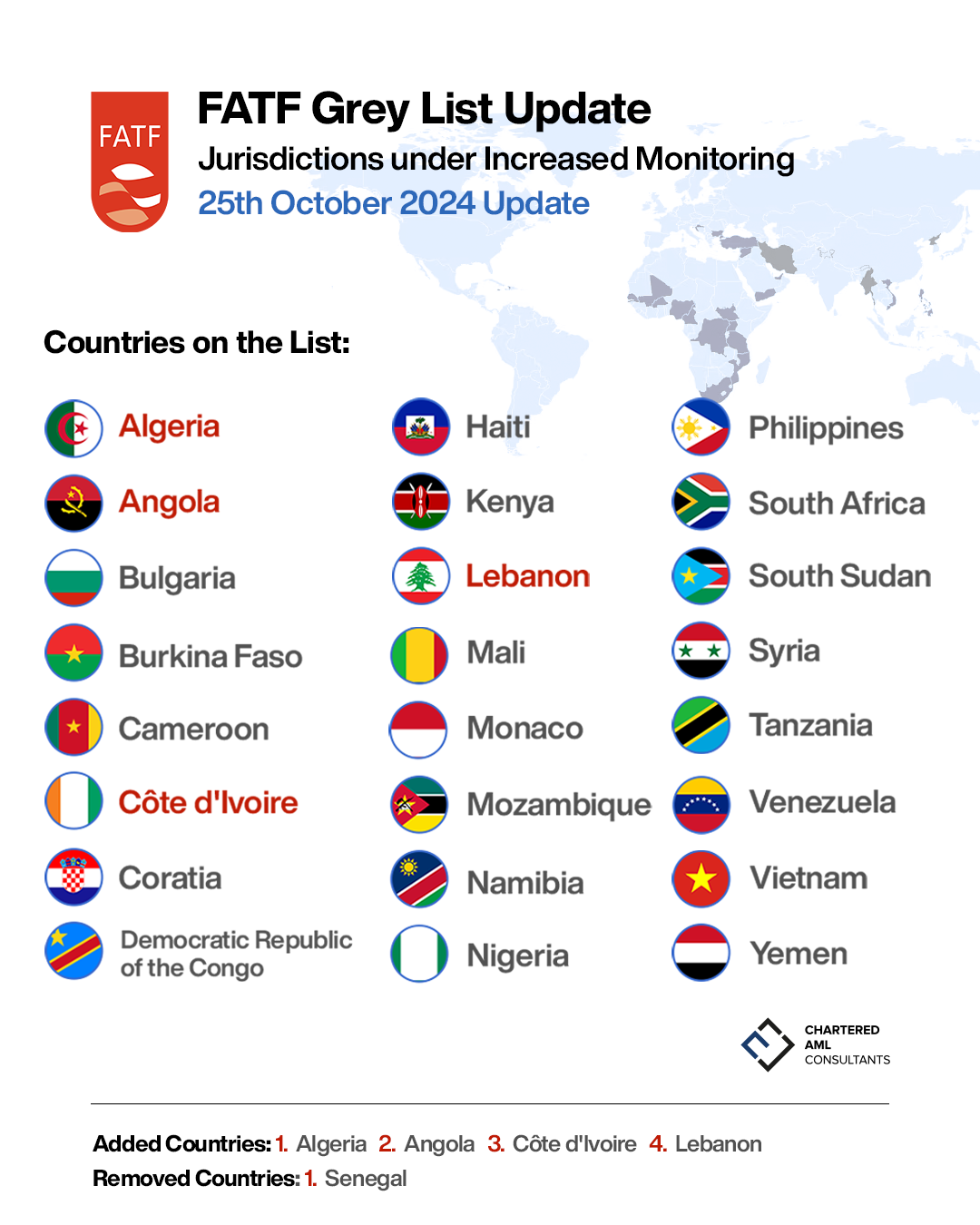

The FATF Grey List for October 2024 has been updated, with significant implications for financial institutions and businesses globally. As of this update, Algeria, Angola, Côte d’Ivoire, and Lebanon have been added to the Grey List, while Senegal has been removed. Understanding these updates is crucial for financial institutions to maintain AML compliance and manage risk effectively.

What Is the FATF Grey List?

The FATF Grey List includes countries that are actively working with the Financial Action Task Force (FATF) to address deficiencies in their AML/CTF measures. These countries must improve their financial regulations to meet international standards. Learn more about the FATF Grey List here.

October 2024 FATF Grey List Update

Countries Added to the Grey List:

- Algeria

- Angola

- Côte d’Ivoire

- Lebanon

Country Removed from the Grey List:

- Senegal

These changes impact compliance procedures for financial institutions and businesses interacting with entities in these jurisdictions. For more details on how our AML Compliance Services can help, visit our service page.

Implications of the FATF Grey List Update

1. Bank Transfers and Financial Transactions

Financial institutions need to apply enhanced due diligence for transactions involving the newly listed countries. This means increased scrutiny of transactions and enhanced reporting requirements to meet compliance standards.

2. Trade Financing

Businesses involved in international trade with these countries must prepare for increased compliance checks. Therefore, additional documentation and longer processing times are expected.

3. Investment Risks

Investors interacting with entities in countries on the FATF Grey List will face higher compliance requirements, which may affect the flow of investments. It is essential to conduct detailed risk assessments and adjust strategies accordingly.

Why Is This FATF Grey List Update Important?

Understanding the FATF Grey List update is essential for maintaining AML compliance and avoiding penalties. It also plays a key role in promoting global financial security.

How CAMC Can Help You Stay Compliant

At Chartered AML Consultants (CAMC), we help businesses adapt to these changes and ensure AML compliance. Visit our Training Programs page to learn more about our customized training solutions.

1. AML Policy Development

We help institutions develop comprehensive AML policies that align with the latest regulatory updates.

2. Transaction Monitoring Solutions

Our advanced transaction monitoring tools help detect suspicious activities and ensure regulatory adherence.

Tips for Businesses to Adapt

- Update Compliance Policies: Ensure that compliance policies are updated to reflect changes in the FATF Grey List.

- Enhanced Due Diligence: Apply enhanced due diligence for all transactions involving newly listed countries.

Conclusion

The October 2024 FATF Grey List update brings Algeria, Angola, Côte d’Ivoire, and Lebanon onto the Grey List, with Senegal being removed. Financial institutions need to understand these changes and adapt their AML compliance strategies to ensure ongoing adherence to global standards.

Contact CAMC today for guidance on AML compliance and risk management.