In the financial world, distinguishing between suspicious activity and suspicious transactions is crucial for effective anti-money laundering (AML) compliance. Both terms are integral to identifying and preventing financial crimes, yet they have distinct definitions and implications.

Suspicious Activity

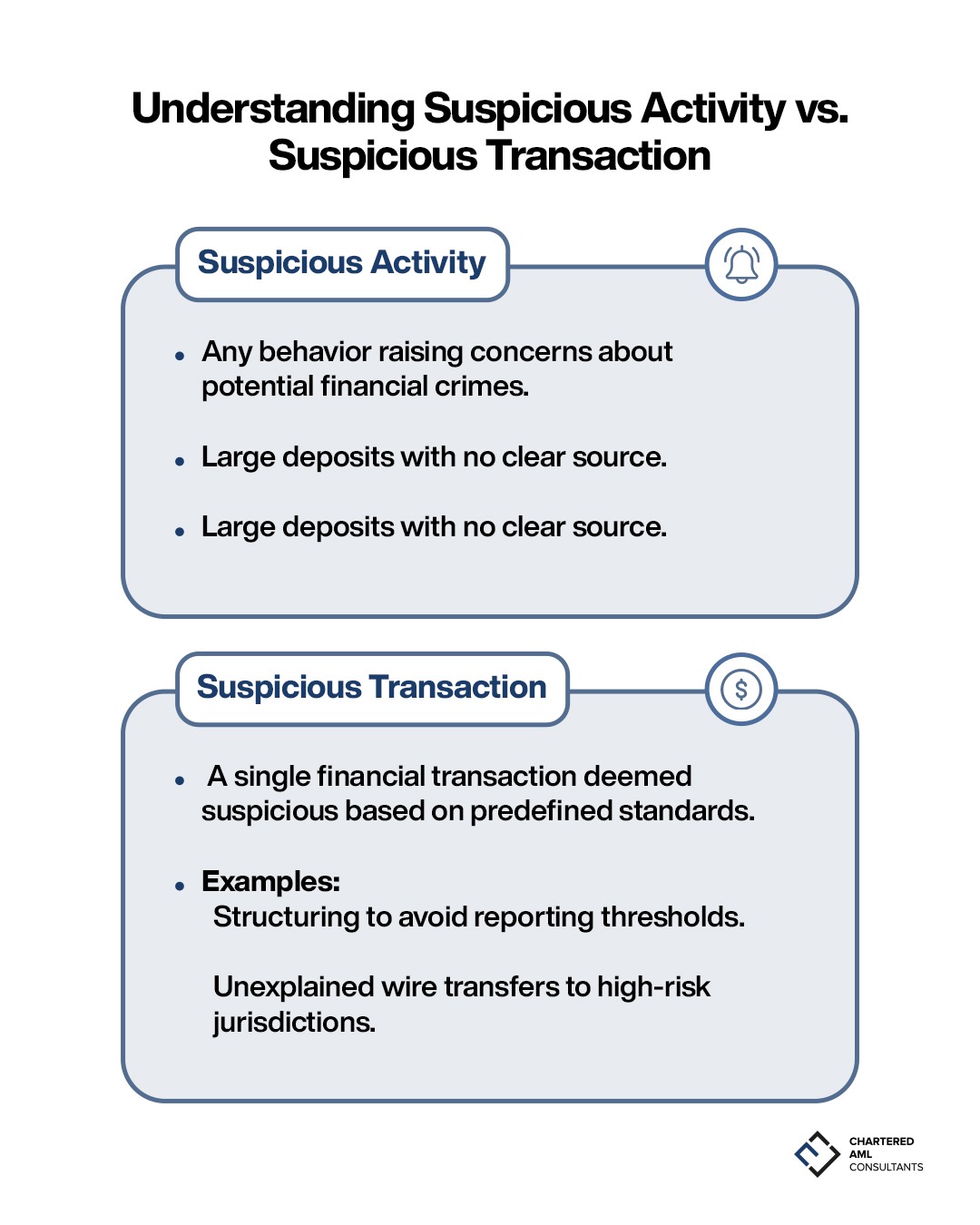

Suspicious activity refers to any behavior that raises concerns about potential financial crimes. It involves patterns or actions that are unusual and may indicate illegal activities. Here are some key characteristics:

- Behavioral Indicators: Any behavior raising concerns about potential financial crimes.

- Unexplained Large Deposits: Large deposits with no clear source.

- Inconsistent Transaction Patterns: Unusual activity not fitting the customer’s typical behavior.

Suspicious Transaction

On the other hand, a suspicious transaction is a specific financial transaction that is deemed suspicious based on predefined standards. These transactions often have characteristics that are directly linked to known methods of money laundering or other financial crimes. Key points include:

- Definition: A single financial transaction deemed suspicious based on predefined standards.

- Examples:

- Structuring: Transactions designed to avoid reporting thresholds.

- Unexplained Wire Transfers: Transfers to high-risk jurisdictions without a clear purpose.

Why This Matters

Knowing the difference between suspicious activity and suspicious transactions helps institutions:

- Enhance their AML compliance programs.

- Better identify and report potential financial crimes.

- Protect their reputation and avoid regulatory penalties.

By implementing robust AML policies and staying informed about the latest regulatory updates, businesses can safeguard their operations and contribute to a secure financial environment. For more information on how CAMC can assist with AML compliance services, visit our services page.